PepsiCo (PEP) has piqued the interest of dividend investors due to a confluence of factors, including strong fundamentals, an attractive valuation, and a recent dip into oversold territory. Dividend Channel’s proprietary DividendRank formula, which assesses thousands of dividend stocks based on a combination of fundamental strength and valuation metrics, has placed PepsiCo in the top 25% of its coverage universe. This high ranking signals that PEP possesses characteristics that warrant further investigation by income-seeking investors. The convergence of strong fundamentals and an attractive valuation provides a compelling foundation for potential investment.

Adding to PEP’s allure is its recent entry into oversold territory. The Relative Strength Index (RSI), a technical indicator used to gauge momentum, has dipped below 30 for PepsiCo, a level typically considered oversold. This suggests that the recent selling pressure on the stock may be nearing exhaustion, potentially creating a buying opportunity for astute investors. While a low RSI doesn’t guarantee a price reversal, it often signals a potential bottoming process, making it a valuable tool for identifying entry points. The current RSI of 29.9 for PEP contrasts with the average RSI of 39.5 for the broader universe of dividend stocks tracked by Dividend Channel.

This dip in price, coupled with PepsiCo’s consistent dividend payout, enhances the stock’s appeal for income-oriented investors. The lower share price translates into a higher dividend yield, making the investment proposition even more attractive. PEP’s annualized dividend of $5.42 per share currently yields 3.51% based on the recent share price of $154.43. This yield is comparatively higher than what it would be at a higher share price, providing an enhanced income stream for investors entering at these levels.

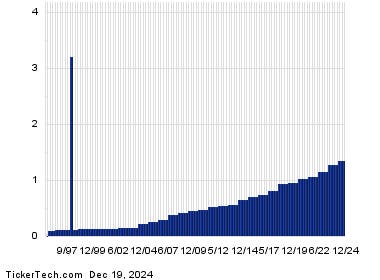

However, while the oversold condition and attractive yield are enticing, investors should delve deeper into PEP’s fundamentals before making any investment decisions. A critical aspect of this due diligence is examining the company’s dividend history. While dividends are not guaranteed and can be influenced by a variety of factors, a consistent history of dividend payments can offer some insight into the company’s commitment to returning value to shareholders. Analyzing the historical dividend trend can help investors assess the likelihood of future dividend payments and their potential growth.

A thorough examination of PepsiCo’s dividend history should include analyzing the payout ratio, which measures the percentage of earnings paid out as dividends. A sustainable payout ratio indicates that the company has sufficient earnings to cover its dividend obligations. Additionally, investors should review the company’s free cash flow, which represents the cash generated from operations after capital expenditures. Strong free cash flow provides a cushion for dividend payments and allows the company to reinvest in growth opportunities.

Furthermore, understanding the company’s overall financial health is crucial. Key metrics such as revenue growth, earnings per share, and debt levels should be carefully scrutinized. A healthy balance sheet and a track record of profitable operations are essential for a company to maintain and potentially increase its dividend payouts over time. Investors should also consider industry trends and competitive pressures to assess the long-term sustainability of the company’s business model and its ability to generate consistent cash flows for dividend payments. Investing in a company with a strong financial foundation increases the likelihood of long-term dividend income and potential capital appreciation.