The passage of the SECURE Act in 2019 and the SECURE Act 2.0 in 2022 marked significant bipartisan efforts to reform the retirement landscape in the United States. These acts aimed to broaden access to tax-advantaged retirement plans, incentivize increased savings, offer greater flexibility in distributions, and simplify retirement planning. However, these changes weren’t without trade-offs. To offset the revenue lost from these enhanced benefits, certain provisions, like the elimination of the Stretch IRA, were implemented, requiring most beneficiaries to fully distribute inherited retirement accounts within ten years, thus accelerating tax realization. While the intricacies of these acts continue to be unpacked by both the retirement community and the IRS, discussions are already underway for a potential SECURE Act 3.0.

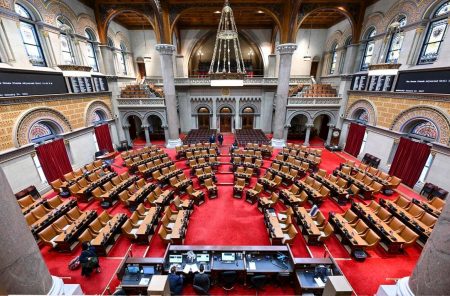

The development of SECURE Act 3.0 mirrors the process of its predecessors, with various stakeholders, including retirement plan professionals and members of Congress, putting forward proposals for further adjustments to the retirement system. These range from specific changes, such as lowering the eligibility age for pension plan participation, to broader systemic shifts. These individual proposals, once collated and refined, are expected to be packaged into a comprehensive legislative effort. This iterative approach to retirement reform, while effective in fostering bipartisan support, adds complexity to an already intricate landscape. The ongoing evolution of retirement legislation requires constant vigilance and adaptation by individuals and financial professionals alike.

While the trajectory of SECURE Act 3.0 is still taking shape, the backdrop of expiring provisions from the 2017 Tax Cuts and Jobs Act adds another layer of complexity to the legislative agenda. The 2025 congressional session will be dominated by decisions regarding the fate of these tax cuts, including which aspects to maintain, modify, or let lapse. Balancing these decisions against the growing national debt and the need for increased revenue will be a central challenge. The confluence of these significant fiscal considerations with the development of SECURE Act 3.0 creates a complex interplay where trade-offs and compromises will be inevitable.

Against this complex fiscal backdrop, the potential benefits of SECURE Act 3.0, while welcomed by some, will likely be accompanied by offsetting tax increases and benefit reductions affecting a broader range of taxpayers. Financing any extension of the 2017 tax cuts and the implementation of new retirement benefits necessitates finding revenue sources, potentially impacting retirees and retirement benefits directly. This delicate balancing act requires lawmakers to carefully weigh the benefits of retirement reform against the broader economic impact of revenue-generating measures.

One potential avenue for generating revenue is the expansion of existing “Stealth Taxes” or the introduction of new ones. These taxes, often indirectly impacting retirement benefits, include the taxation of Social Security benefits, the Medicare premium surtax, and the net investment income tax. Another recurring proposal involves “Rothification” of retirement plans, essentially shifting the tax burden from upfront deductions to distributions. This approach, while offering potential long-term benefits, would eliminate the immediate tax advantages of traditional retirement contributions. The potential implications of Rothification and the expansion of stealth taxes require careful consideration about their long-term impact on retirement security.

Further complicating the future of retirement planning are resurrected proposals from previous legislative sessions. These include measures to accelerate distributions from substantial retirement accounts, impose direct taxes on large balances, and restrict investment options within certain IRAs. While the broader public may focus on high-profile issues like the 2017 tax cut extensions, individuals nearing or in retirement must pay close attention to the specifics of any proposed SECURE Act 3.0. The nuances of these complex legislative proposals, often overlooked in the broader public discourse, can significantly impact retirement planning strategies and overall financial well-being. The evolving retirement landscape necessitates staying informed and adapting to the ever-changing legislative environment.