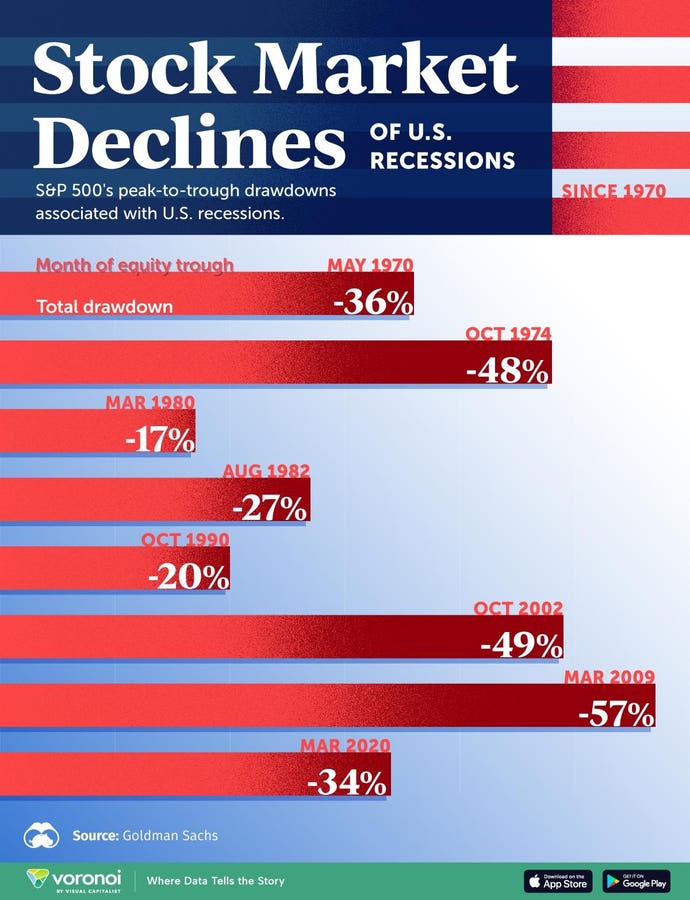

The allure of short-term market gains often overshadows the potential for substantial long-term wealth creation. A compelling example illustrates this point: investing $1 million in the S&P 500 at the end of 1972, right before a near-50% market crash spanning 1973 and 1974, would have resulted in a staggering $200+ million by the end of 2024. This 200-fold increase, despite the initial significant losses, underscores the power of long-term investing. This principle holds true even in the face of market volatility, as demonstrated by the performance of Trefis HQ Portfolio Strategy, which has outperformed the S&P 500 since its inception in 2020. The key takeaway is to resist emotional reactions to short-term market fluctuations and maintain a focus on long-term goals.

A central challenge in investing is overcoming the human tendency to invest during periods of exuberance and retreat during periods of fear. This often leads to buying high and selling low, which is detrimental to long-term returns. The solution lies in prioritizing long-term goals and resisting impulsive reactions to market movements, especially during periods of volatility. This long-term perspective is crucial, as it allows investors to capitalize on the compounding effect of returns over time. This requires a disciplined approach, focusing on the overall investment horizon rather than short-term market fluctuations.

The potential for extraordinary returns through long-term investing is often underestimated. A 10% or 15% annual return on a $1 million investment over 50 years can yield $100 million or even $1 billion, respectively. While a 2x return in a year or two may seem attractive, it pales in comparison to the potential for a 1,000x return over the long term. This underscores the importance of focusing on long-term growth rather than chasing short-term gains, which can often lead to impulsive decisions and missed opportunities for substantial wealth creation. The Trefis HQ portfolio strategy’s success further reinforces the effectiveness of a long-term, disciplined approach.

“Actively boring” investing involves a proactive approach to long-term wealth building. This strategy entails resisting emotional reactions to market fluctuations and actively seeking information to make informed decisions. Two actionable steps are recommended: setting calendar reminders for significant market events, such as Fed meetings, and reviewing past market crashes to gain perspective; and consulting with a trusted team of financial experts to develop a long-term investment strategy tailored to individual goals. This team can provide valuable insights and guidance, helping investors navigate market volatility and stay focused on their long-term objectives.

Collaborating with a trusted team of experts is essential for successful long-term investing. A team can provide personalized guidance, help set achievable goals, and offer support during periods of market volatility. This collaborative approach can help investors resist impulsive reactions and maintain a long-term focus. Building a relationship with experienced professionals like Glenn Caldicott, CIO of Empirical, and leveraging the expertise of a team with a proven track record, such as the Trefis team, can significantly enhance long-term investment outcomes. These experts can provide insights into market trends, alternative investment strategies, and effective asset allocation strategies to preserve and grow wealth.

The “actively boring” approach contrasts with passive index fund investing by emphasizing continuous learning and data-driven decision-making. This involves resisting impulsive reactions while actively seeking information and analyzing market trends. It also requires setting clear, written long-term goals and developing a plan with a team of experts. This proactive approach enables investors to make informed decisions aligned with their long-term objectives, rather than simply reacting to short-term market fluctuations. This approach fosters a more disciplined and strategic approach to investing, leading to greater long-term success.