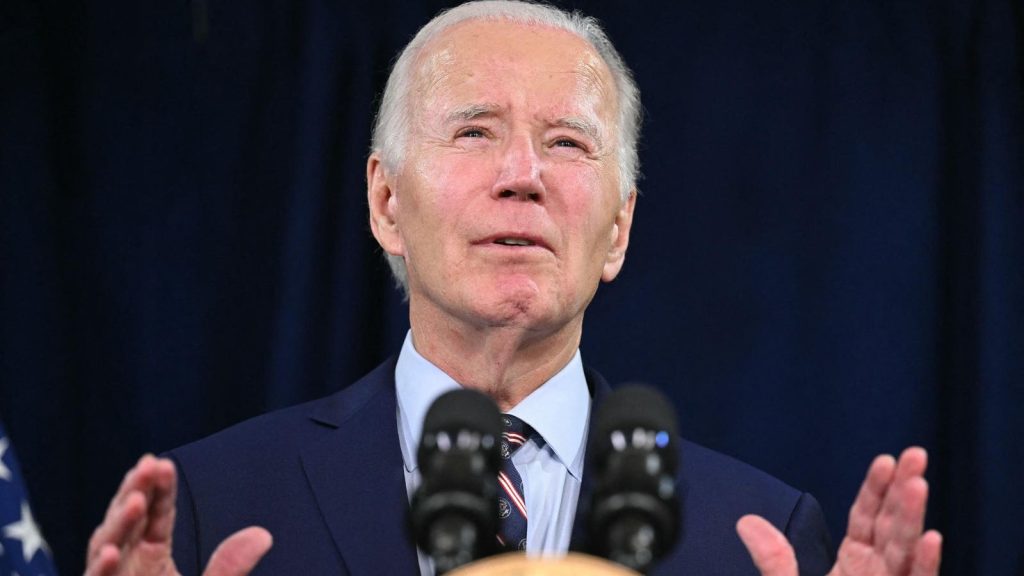

The Department of Education has temporarily suspended the processing of applications for the Total and Permanent Disability (TPD) Discharge program, a critical initiative designed to alleviate the student loan burden for borrowers with severe medical impairments. This pause, while part of a pre-planned effort to modernize and streamline federal student loan programs, introduces another layer of complexity for borrowers already grappling with a turbulent student loan landscape. The TPD Discharge program, offering a pathway to complete federal student loan forgiveness, is designed for individuals whose medical conditions prevent them from engaging in substantial gainful activity. Eligibility hinges on the condition being terminal or having persisted for at least five years, or being expected to continue for at least five more years. The Biden administration has implemented significant improvements to the program, making it easier for eligible borrowers to obtain much-needed relief.

The TPD Discharge program provides several avenues for borrowers to qualify for student loan forgiveness. Veterans Affairs (VA) certification for a service-connected disability and receipt of Social Security Disability Insurance (SSDI) benefits under specific circumstances are two such pathways. Alternatively, borrowers can submit certification from a qualified medical professional attesting to their condition meeting the TPD Discharge criteria. A significant feature of the program is the automated identification of eligible borrowers through data-sharing initiatives between the Department of Education, the VA, and the Social Security Administration. This streamlined process automatically grants discharge unless the borrower chooses to opt out. However, those applying through medical professional certification must typically submit a formal application, a process that usually takes two to three months, during which loan payments are typically suspended.

The Biden administration has championed significant reforms to the TPD Discharge program to enhance accessibility and efficacy. These reforms include broadening the range of accepted medical professionals who can certify a borrower’s disability, simplifying the qualification process for SSDI beneficiaries, and eliminating the controversial post-discharge income monitoring that often led to the reversal of forgiveness. These improvements have resulted in substantial relief for borrowers, as evidenced by the $16.2 billion in TPD discharges granted to nearly 572,000 individuals as of December, a testament to the program’s impact.

Despite these positive strides, the TPD Discharge program has now entered a temporary processing pause. This suspension is a component of a broader initiative to consolidate various federal student loan programs under the umbrella of StudentAid.gov, the Education Department’s centralized web portal. This transition aims to improve user experience and streamline management of federal student loans and grants. While the pause is expected to last until spring 2025, borrowers can still submit their TPD forms. The Department of Education assures continued forbearance during the processing pause, providing temporary relief from loan payments while applications are pending.

The timing of this TPD Discharge pause, while planned, coincides with a period of considerable upheaval within the federal student loan system. The Public Service Loan Forgiveness (PSLF) program underwent a similar transition in the summer of 2024, migrating from an external servicer to StudentAid.gov. This transition, while ultimately successful, was marred by temporary setbacks including processing delays, backlogs, and data inaccuracies, causing significant uncertainty for many borrowers. The PSLF program is now largely stabilized, albeit with some lingering delays. This experience highlights the potential challenges and complexities associated with such system-wide transitions.

Adding to the complexities are ongoing issues with other student loan forgiveness initiatives. The Saving on a Valuable Education (SAVE) plan, the Biden administration’s flagship income-driven repayment program, is currently stalled due to a federal appeals court injunction, leaving millions of borrowers trapped in administrative forbearance. This delay prevents them from making progress toward loan forgiveness under income-driven repayment plans or PSLF. Further compounding the situation, the Biden administration recently withdrew its broader student loan forgiveness plans, anticipating their reversal by the incoming Trump administration. This confluence of events creates a challenging and uncertain landscape for borrowers seeking student loan relief.