The looming possibility of significant tax reform in 2025 hangs over the political landscape, with many anticipating that a Republican-controlled Congress will utilize the reconciliation process to push through major changes. While the timing remains uncertain, speculation points towards two potential scenarios: a rapid push within the first 100 days focusing on non-tax priorities like border security and energy, followed by a separate reconciliation bill specifically targeting tax reform; or a single, more comprehensive bill later in the year. However, the inherent complexities of reconciliation and the narrow congressional majorities present formidable hurdles to enacting any substantial legislative changes. The success of any such endeavor hinges on a delicate balance of political maneuvering, compromise, and presidential involvement.

The reconciliation process itself presents a series of intricate steps that must be meticulously navigated. First, both the House and Senate must pass a budget resolution outlining the permitted level of deficit spending attributable to the proposed legislation within a specific timeframe. This sets the stage for the subsequent legislative action. Crucially, the process demands deficit neutrality beyond the designated budget window, meaning any increase in the deficit caused by the bill must be offset by other revenue-generating measures or spending cuts. Finally, the proposed legislation must secure passage in both chambers of Congress, a process likely fraught with intense debate and negotiation given the slim majorities. Ultimately, presidential approval is the final hurdle, requiring the President to sign the bill into law. This necessitates active engagement from the executive branch throughout the process.

A significant factor influencing the debate is the cost of extending the expiring provisions of the Tax Cuts and Jobs Act (TCJA), enacted in 2017. The Congressional Budget Office (CBO) projects that extending these provisions, including popular measures like bonus depreciation, would add a substantial $4.6 trillion to the federal deficit over the next decade (2025-2034). This substantial fiscal impact underscores the complex trade-offs facing lawmakers as they consider both extending existing tax cuts and enacting new ones.

Fueling the debate are several key tax reform proposals currently under consideration, each carrying significant implications for the federal deficit. These include proposals to eliminate taxes on overtime pay (estimated cost: $300 billion), exempt tips from taxation ($200 billion), reduce the corporate tax rate to 15% ($500 billion), reinstate immediate expensing of research and development costs ($300 billion), and remove the cap on the State and Local Tax (SALT) deduction ($1.2 trillion). Collectively, these proposals represent a potential $7.1 trillion increase in the deficit, a figure that underscores the need for offsetting measures to mitigate the fiscal impact.

However, enacting such sweeping tax cuts without addressing the resulting deficit increase is politically untenable. Therefore, a range of potential offsets are being explored to counterbalance the cost of these tax reductions. These include eliminating existing energy credits (estimated savings: $300 billion), implementing new tariffs ($1 trillion), and enacting budget cuts. Discussions surrounding a potential “Department of Government Efficiency” (DOGE), championed by figures like Elon Musk and Vivek Ramaswamy, suggest the possibility of identifying up to $2 trillion in government spending cuts over the next decade. Even with these proposed offsets, the overall deficit impact of the discussed tax reforms could still reach $3.8 trillion by 2034, highlighting the significant fiscal challenges involved.

The path forward for tax reform is paved with uncertainty and intense political negotiation. The interplay between competing priorities, fiscal constraints, and political maneuvering will shape the final outcome. While the current discussions provide a glimpse into the potential direction of tax reform, the eventual legislation is likely to evolve significantly through the legislative process. Special interest groups are already mobilizing, adding another layer of complexity to the debate.

The potential scale of tax reform in 2025 is significant. The range of proposals currently under discussion represents a fundamental reshaping of the tax code, impacting individuals, businesses, and the overall economy. Navigating the intricate reconciliation process, balancing competing interests, and addressing the substantial fiscal implications will require deft political maneuvering and a willingness to compromise. The outcome of these negotiations will have far-reaching consequences for the American economy and the fiscal health of the nation. The political theater of tax reform is set to unfold, and the stakes are high.

The political dynamics surrounding tax reform are complex and multifaceted. The Republican Party’s internal divisions on fiscal policy could complicate efforts to achieve consensus on a comprehensive tax package. Simultaneously, the narrow Democratic majority in the Senate presents a formidable challenge, requiring bipartisan support for any major legislative initiatives. The President’s role in shaping and influencing the debate will be crucial, requiring a delicate balancing act between advocating for his agenda and navigating the complexities of congressional negotiations.

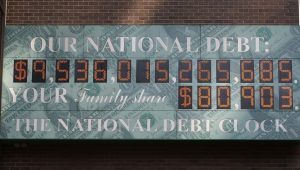

Furthermore, the broader economic context will significantly influence the trajectory of tax reform. Factors such as economic growth, inflation, and interest rates will shape the debate surrounding the affordability and long-term implications of proposed tax cuts. The ongoing debate about the national debt and the need for fiscal responsibility adds another layer of complexity, requiring policymakers to balance the potential economic benefits of tax cuts against the potential risks of exacerbating the national debt.

The potential impact of tax reform on various sectors of the economy will also be a key consideration. Different industries and demographic groups will be affected differently by specific tax provisions, leading to intensive lobbying efforts and political maneuvering. The debate over the distributional effects of tax cuts, particularly the impact on income inequality, will likely be a central theme in the political discourse.

The road to tax reform in 2025 is fraught with challenges and uncertainties. The complex interplay of political dynamics, fiscal constraints, and economic considerations will shape the ultimate outcome. While the current proposals offer a glimpse into the potential direction of reform, the final legislation will likely emerge from a protracted process of negotiation and compromise. The stakes are high, and the outcome will have significant implications for the American economy and the nation’s fiscal future.