Navigating Tech Stock Volatility with High-Yielding CEFs

The tech sector, often represented by the NASDAQ 100 index, has demonstrated remarkable long-term growth, significantly outperforming the S&P 500. However, current market conditions suggest a potential pullback. The NASDAQ’s elevated price-to-earnings ratio, exceeding levels seen since the dot-com bubble, raises concerns about overvaluation. While the transformative potential of artificial intelligence (AI) contributes to this valuation, the increasing competitiveness and accessibility of AI technologies could moderate future growth for large-cap AI stocks. Furthermore, the resurgence of cryptocurrency markets presents another potential source of volatility, reminiscent of the 2021 surge and subsequent 2022 crash, and the inclusion of crypto-related stocks like MicroStrategy in the NASDAQ 100 adds to the overall risk profile.

To mitigate these risks while still capitalizing on the tech sector’s potential, a strategic approach involves investing in closed-end funds (CEFs) that offer diversification, high yields, and active management. CEFs allow investors to gain exposure to a diversified portfolio of tech companies, including those benefiting indirectly from AI advancements outside the tech sector. For example, the Adams Diversified Equity Fund (ADX) provides a 9% yield while holding prominent AI players like Microsoft, Alphabet, and NVIDIA, alongside companies like JPMorgan Chase and Visa, which are leveraging AI for enhanced operations and decision-making. This strategy minimizes exposure to volatile cryptocurrencies while focusing on the broader impact of AI across various industries.

The resurgence of cryptocurrency markets presents a parallel to the 2021 crypto boom and subsequent 2022 bust, raising concerns about another potential cycle of inflated valuations and sharp corrections. The inclusion of MicroStrategy, a company heavily invested in Bitcoin, in the NASDAQ 100 exemplifies this risk. While the individual performance of a single volatile stock might not significantly impact a broad index, it highlights the potential for amplified volatility and the importance of active risk management.

CEFs offer a distinct advantage over index funds by providing active management that can navigate around specific risks, such as highly volatile crypto-related stocks. Unlike index funds, which must passively track the entire index, CEF managers can selectively invest in companies they deem less risky while maintaining a focus on generating attractive income. This flexibility proves particularly valuable in navigating potentially turbulent market conditions, where active managers can adjust their portfolios to minimize exposure to overvalued or unstable assets. This proactive approach enhances the potential for consistent returns and reduces the impact of market downturns.

Furthermore, CEFs generally offer higher dividend yields than traditional index funds, providing investors with a steady stream of income. This feature becomes particularly advantageous during periods of market volatility, as the high dividend payouts cushion against potential capital losses and allow investors to capture a larger portion of their returns in cash rather than relying solely on price appreciation. This income-focused approach enhances overall portfolio stability and provides a consistent return stream regardless of market fluctuations.

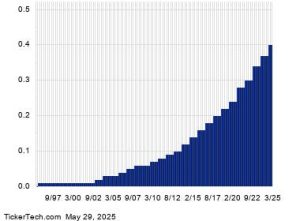

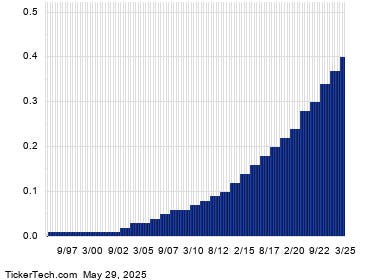

Tech-focused CEFs currently offer an average yield of around 8%, significantly higher than the 0.5% yield of the Invesco QQQ Trust, a popular NASDAQ 100 index fund. This substantial income stream allows investors to realize profits from tech investments more readily, without relying solely on potentially volatile market price movements. Comparing the performance of tech CEFs like the BlackRock Science and Technology Trust (BST) and the BlackRock Science and Technology Term Trust (BSTZ) against the QQQ reveals the benefits of this income-oriented approach. While BST’s market price performance may have lagged the index, its total return, including dividends, remained competitive. BSTZ, with its focus on private equity, experienced a slower recovery, impacting its total return. However, both CEFs offer a crucial advantage: they avoid direct exposure to the cryptocurrency market, providing greater stability and mitigating the risks associated with volatile crypto-related stocks. This risk management approach positions these CEFs favorably in the event of another cryptocurrency market downturn.

In conclusion, while the tech sector offers attractive growth potential, the current market environment warrants a cautious approach. High valuations, the evolving AI landscape, and the resurgence of cryptocurrency create uncertainties and potential risks for investors. However, strategically investing in high-yielding, actively managed tech-focused CEFs offers a compelling solution. These funds provide diversified exposure to the tech sector, including companies leveraging AI for growth, while mitigating risks associated with volatile crypto-related stocks. The higher dividend yields offered by CEFs provide a steady income stream and enhance overall portfolio stability. This actively managed, income-oriented approach positions investors to participate in the tech sector’s growth while mitigating potential downside risks and achieving a more balanced and resilient investment strategy.