Rigetti Computing: A Speculative Bet on the Quantum Future

Rigetti Computing, a pioneer in the nascent quantum computing industry, has captured attention for its innovative superconducting qubit technology and its position as one of the few publicly traded pure-play quantum companies. However, its lofty valuation, trading at a price-to-sales (P/S) ratio exceeding 200, raises concerns about speculative exuberance overshadowing fundamental value. This analysis delves into Rigetti’s operations, financials, valuation, and the broader quantum computing landscape to assess its investment prospects.

Rigetti’s business model centers on Quantum Computing-as-a-Service (QCaaS), offering cloud-based access to its quantum systems and generating recurring revenue through subscriptions. It also provides on-premises quantum systems to research institutions and government agencies, diversifying its revenue streams further with hardware sales and co-development projects. Despite these promising avenues, Rigetti remains in its early stages, reporting net losses and a valuation that appears significantly inflated based on traditional financial metrics. The company’s high P/S ratio, exceeding those of even high-growth tech companies, suggests investors are betting heavily on its future potential rather than its current performance.

The recent volatility in Rigetti’s stock price, marked by a sharp decline following comments by NVIDIA’s CEO about the long-term horizon for commercially viable quantum computing, underscores the inherent risks in such speculative investments. While the long-term potential of quantum computing is undeniable, with projections of trillions of dollars in economic value creation by 2035, the timeline for realizing this potential remains uncertain. Investing in Rigetti at current valuations requires a significant leap of faith that the company will not only achieve its ambitious growth targets but also maintain its technological leadership in a rapidly evolving field.

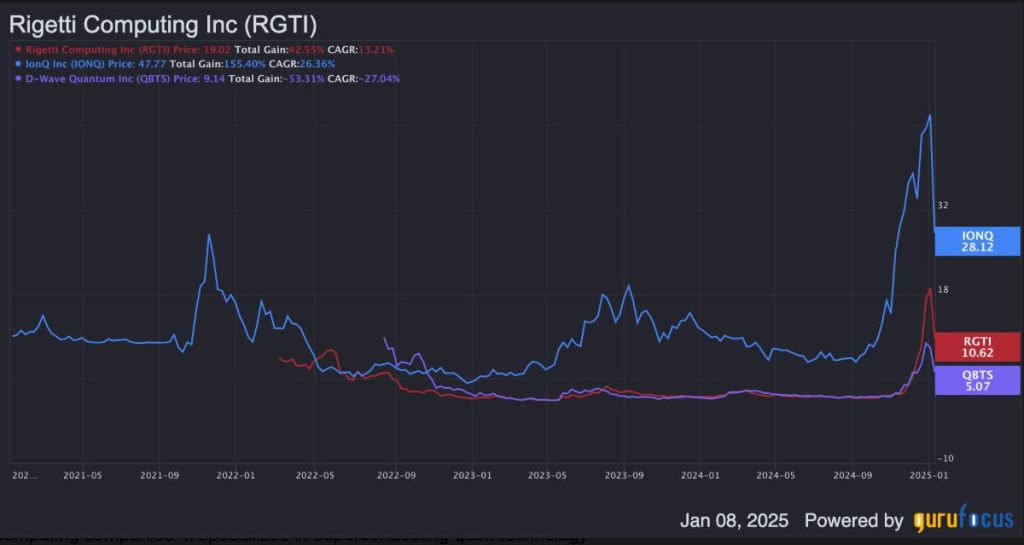

A comparative analysis of Rigetti’s valuation with other publicly traded quantum computing companies reinforces the view that its stock is overpriced. While companies like IonQ and D-Wave Quantum also exhibit high valuations relative to their current financial performance, Rigetti’s P/S ratio far surpasses theirs, even after considering optimistic revenue growth projections. This premium valuation suggests that market sentiment, driven by the hype surrounding quantum computing, has detached from fundamental analysis. While some investors might draw parallels to other "story stocks" like Tesla or Palantir, Rigetti lacks the established brand recognition or track record of sustained high sentiment that could justify such a premium.

The quantum computing industry itself holds immense promise, with the potential to revolutionize numerous sectors, from logistics and manufacturing to healthcare, finance, and cybersecurity. Quantum computers’ ability to solve complex problems far beyond the capabilities of classical computers promises to unlock breakthroughs in drug discovery, materials science, artificial intelligence, and other fields. However, the realization of this potential is still years, perhaps decades, away. While the long-term prospects are exciting, investors should approach the sector with caution, focusing on companies with reasonable valuations and demonstrable progress towards commercial viability.

For value-oriented investors, Rigetti’s current valuation presents a significant barrier to entry. While the company operates at the cutting edge of a transformative technology, the price of its stock reflects an excessive level of optimism about its near-term prospects. A more prudent approach would be to wait for a substantial correction in the stock price, bringing its valuation more in line with its fundamentals, or to seek investment opportunities in other quantum computing companies with more reasonable valuations and demonstrable paths to profitability. The potential of quantum computing is vast, but investors should prioritize sound financial analysis over speculative fervor when making investment decisions in this emerging field.