The Trump Administration’s "5-Day Plan" and the Future of Crypto in the US

Donald Trump’s post-election focus on digital finance policy, dubbed the "5-Day Plan," represents a radical departure from traditional presidential transitions. His commitment to fostering US leadership in fintech, crypto, and digital assets has triggered a wave of policy changes, including key appointments and the issuance of a landmark executive order. This executive order sets the stage for significant legislative action over the next year, aiming to ban central bank digital currencies (CBDCs) while promoting industry-backed stablecoins and public blockchains. It also emphasizes regulatory clarity and tech neutrality, signifying a stark shift from the previous administration’s approach to digital assets. The creation of a new crypto task force within the SEC and the repeal of the controversial SAB121 accounting guidance are intended to further unlock institutional investment in the crypto market. This rapid policy shift positions the US as a global competitor in the digital asset space, a move perceived by some as a direct response to the growing influence of other nations, particularly China, in the field of artificial intelligence and financial technology.

Trump’s Personal Stake and the "Confidence Trick" of Crypto

The alignment of Trump’s crypto policies with his personal business interests, including the launch of Trump-branded digital assets and the foray of his social media platform, Truth Social, into fintech, raises questions about potential conflicts of interest. While proponents argue that this involvement will drive mainstream adoption and benefit average Americans, critics express concern that it could primarily enrich those already wealthy, further exacerbating economic inequality. The underlying principle of trust, crucial for the success of any financial system, including the crypto ecosystem, is being tested. All forms of money, including the US dollar and Bitcoin, rely on confidence; they are essentially "confidence tricks." The challenge for the Trump administration is to build and maintain public trust in crypto as a legitimate asset class, ensuring that its potential benefits are accessible to all Americans and not just a select few. This requires demonstrable improvements in the financial well-being of ordinary citizens, rather than simply enriching those already at the top.

The Regulatory Balancing Act and the Global Crypto Race

The task before US regulators is complex. They must balance the administration’s deregulatory agenda with the need for robust oversight to protect investors and maintain financial stability. New legislation and clear regulatory frameworks are crucial for the maturation and scaling of the crypto industry, but these frameworks must avoid stifling innovation with excessive red tape. The Trump administration’s actions have intensified the global competition for crypto leadership, prompting other jurisdictions to accelerate their own legislative efforts. This creates a race where the most attractive regulatory environment will likely attract the most investment, talent, and innovation. Each country must navigate the delicate balance between fostering innovation and ensuring financial stability, while also considering global regulatory standards.

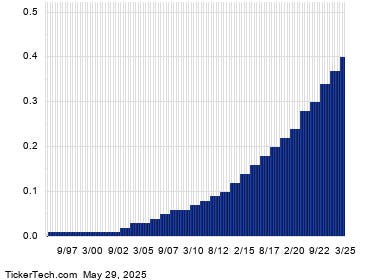

Beyond the US: Global Crypto Adoption and Competition

The adoption of cryptocurrencies is a global phenomenon, with individuals holding a significant portion of Bitcoin. Emerging economies like India, Indonesia, and Brazil, with their large populations and increasing crypto adoption rates, present attractive growth opportunities for crypto businesses. While the US is vying for leadership, it faces competition from other nations with significant crypto holdings and favorable regulatory environments. The UAE, for example, reportedly holds substantial Bitcoin reserves and offers a tax-friendly environment for large investors. The UK, with its established fintech hub in London, also poses a strong challenge. The competition is not just about capital and talent but also about attracting widespread consumer adoption of cryptocurrencies.

Speed and Agility: Key Factors in the Global Crypto Race

The speed of policy implementation is becoming a critical factor in the global crypto race. The US, with its renewed focus on digital assets, is aiming for rapid legislative progress within the next six to twelve months. Other jurisdictions must respond with similar agility to avoid falling behind. This requires governments to work closely with industry experts to develop effective and efficient regulatory frameworks. The ability to adapt quickly to the evolving crypto landscape will be crucial for success. The stakes are high: attracting the next generation of global tech companies, with the accompanying investment, skills, jobs, and tax revenue.

The UK’s Challenge and the Need for Global Collaboration

The US’s rapid advancement in crypto policy has put pressure on other nations, particularly the UK, which has aspirations to become a global crypto hub. The recent closure of Andreessen Horowitz’s UK office and reports of UK fintech companies facing difficulties opening bank accounts raise concerns about the country’s competitiveness. The UK must act decisively to create a more welcoming environment for crypto businesses and demonstrate a genuine commitment to the economic benefits of digital assets. Ultimately, the global crypto landscape requires international cooperation. While competition is inevitable, collaboration on regulatory frameworks and standards will be essential to ensure the responsible and sustainable development of the crypto ecosystem. This includes addressing issues such as money laundering, consumer protection, and financial stability. The future of crypto depends on finding a balance between fostering innovation and mitigating risks, a challenge that requires a global approach.