Schlumberger (SLB), a leading global oilfield services provider, is set to trade ex-dividend on February 5, 2025. This means that investors who purchase SLB shares on or after this date will not be entitled to the upcoming quarterly dividend payment of $0.285 per share, scheduled for April 3, 2025. The ex-dividend date is an important marker for investors, as the stock price typically adjusts downwards by approximately the amount of the dividend on this date, reflecting the reduced value of the shares without the impending dividend payment. In this case, the $0.285 dividend represents approximately 0.71% of SLB’s recent stock price of $40.28, suggesting a potential 0.71% decrease in the stock price on the ex-dividend date, assuming all other market factors remain constant.

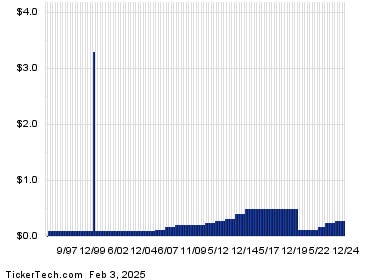

Understanding historical dividend payments can offer valuable insights into a company’s dividend policy and potential future payouts. While dividends are never guaranteed, examining past trends can help investors assess the likelihood of continued dividend payments and the reasonableness of the current estimated yield. Schlumberger’s historical dividend data reveals fluctuations in the payout amount over time. While the most recent declared dividend is $0.285, previous payments have varied. This information, coupled with the current annualized yield of 2.83%, serves as a basis for evaluating the sustainability and potential future trajectory of SLB’s dividend payments. Investors should consider various factors, including the company’s financial performance, industry outlook, and overall market conditions, when assessing the long-term prospects of dividend income from SLB.

The performance of SLB’s stock price over the past year, particularly in relation to its 200-day moving average, provides further context for evaluating the investment. The stock’s 52-week range, from a low of $36.5192 to a high of $55.69, reflects the price volatility experienced during this period. The last traded price of $39.58 positions the stock closer to its 52-week low, suggesting the potential for price appreciation but also highlighting the inherent market risks. The 200-day moving average serves as a technical indicator, smoothing out short-term price fluctuations and providing a broader perspective on the stock’s trend. Analyzing the stock’s movement relative to this average can help investors identify potential buying or selling opportunities and gauge the overall market sentiment towards SLB.

On Monday, prior to the ex-dividend date, SLB shares experienced a decline of approximately 1.8%. This daily price movement underscores the inherent volatility of the stock market and the influence of various factors on share prices. While the upcoming ex-dividend date may contribute to a further price adjustment, it’s crucial to recognize that numerous other market dynamics can influence daily trading activity. News related to the company’s performance, the broader energy sector, or overall economic conditions can all impact investor sentiment and drive price fluctuations.

For income-oriented investors, understanding the interplay of dividends, stock price fluctuations, and market trends is essential for making informed investment decisions. Resources like ValueForum.com offer platforms for in-depth discussions and analysis of income investing strategies. Engaging with other investors and experts can provide valuable perspectives and insights into navigating the complexities of dividend investing and maximizing returns while managing risks.

In summary, the upcoming ex-dividend date for Schlumberger on February 5, 2025, marks a significant event for investors. The anticipated price adjustment, coupled with the historical dividend data, stock performance analysis, and current market conditions, provides a comprehensive framework for evaluating the investment potential of SLB. By considering these factors and engaging with resources like ValueForum.com, investors can make more informed decisions regarding their investment strategy and navigate the dynamic landscape of the stock market. The ex-dividend date serves as a reminder of the importance of understanding the mechanics of dividend payments and their impact on stock prices. It also highlights the need for continuous monitoring of market trends and company performance to optimize investment outcomes.