The Allure of New Dividend Stocks and the Dividend Magnet Effect

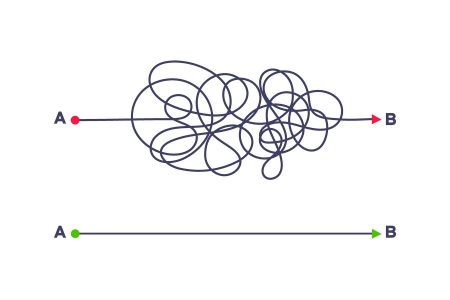

The world of dividend investing is constantly evolving, with new companies initiating dividend programs and attracting investors seeking stable income streams. Contrarian Outlook, a publication focused on dividend investing, emphasizes the "Dividend Magnet" phenomenon, where stock prices tend to follow the trajectory of their dividend payouts over the long term. Dividend growth stocks are particularly attractive because they offer both income and the potential for capital appreciation as the stock price rises to match the increasing dividend. New dividend payers are even more compelling because they often exhibit rapid dividend growth in their early years, signaling confidence in their future earnings and a commitment to rewarding shareholders.

Shifting Perceptions of Dividend Initiations on Wall Street

Traditionally, the announcement of a new dividend was sometimes perceived negatively, as if it signaled the end of a company’s growth phase. However, this perception is changing. Investors are increasingly recognizing that initiating a dividend can be a sign of financial strength and a commitment to returning value to shareholders. The example of Meta Platforms (META) demonstrates this shift, with the stock price appreciating after the announcement of its inaugural dividend. This changing sentiment creates opportunities for investors who understand the significance of new dividend initiations.

Seven Newly Initiated Dividend Programs: A Closer Look

Over the past six months, several companies have announced new dividend programs, offering a diverse range of investment opportunities. These new dividend payers come from various sectors, including land management, IT services, financial services, benefits solutions, online dating, cybersecurity, and energy infrastructure. Their dividend yields range from a modest 0.5% to a more substantial 8.5%, catering to different income needs and risk tolerances.

LandBridge (LB), a land management company operating in the Permian Basin, exemplifies the high-growth potential of new dividend payers. Its stock price quadrupled after its IPO in 2024, and the company quickly initiated a quarterly dividend. CGI Inc. (GIB), a long-established IT services provider, initiated its first dividend after decades on the public market, signaling a shift in its capital allocation strategy. Marex Group (MRX), a U.K.-based financial services provider, offers a higher dividend yield and has a history of growth through acquisitions, making it an attractive option for income-seeking investors.

Alight (ALIT), a cloud-based benefits solutions provider, surprised investors by initiating a dividend despite posting GAAP losses. The company’s strong cash flow and recurring revenue model suggest sustainability, albeit with some risk. Match Group (MTCH), the parent company of popular dating apps like Tinder and Hinge, introduced a dividend and share repurchase program to reward shareholders despite facing some headwinds in its core business. OneSpan (OSPN), a cybersecurity company, offers a decent initial yield and has indicated a commitment to exploring further shareholder returns through various means, including dividend increases.

South Bow (SOBO), an energy infrastructure company spun off from TC Energy (TRP), initiated a high-yield dividend, typical of the energy sector. This spin-off benefits from long-term contracts, providing stability and visibility for its dividend payments. The diversity of these new dividend payers allows investors to tailor their portfolios to specific income requirements and risk profiles.

Evaluating New Dividend Stocks: Considerations and Cautions

While new dividend stocks can present attractive opportunities, it’s crucial to conduct thorough due diligence before investing. Understanding the company’s financial health, business model, and growth prospects is essential. Factors such as payout ratios, debt levels, and the sustainability of earnings should be carefully examined. In the case of newly listed companies or spin-offs, limited historical data can make it challenging to assess long-term trends, requiring a more forward-looking analysis based on projected cash flows and market conditions.

Moreover, investors should not solely focus on the dividend yield. A high yield can sometimes be a red flag, indicating financial distress or unsustainable payout ratios. It’s important to consider the overall investment case, including the company’s competitive position, industry dynamics, and potential for future growth. By analyzing these factors in conjunction with the dividend yield, investors can make more informed decisions about allocating their capital.

The Importance of Diversification and Long-Term Perspective

As with any investment strategy, diversification is crucial when investing in new dividend stocks. Spreading investments across various sectors and companies can mitigate the risks associated with individual stock performance. Additionally, adopting a long-term perspective is essential. The "Dividend Magnet" effect, where stock prices tend to follow dividend growth, typically plays out over years, not months. Patience and a focus on the long-term fundamentals of the companies can lead to more consistent and substantial returns.

By understanding the dynamics of new dividend payers, conducting thorough research, and maintaining a long-term perspective, investors can leverage the potential of these investments to generate income and build wealth over time. The seven examples highlighted above provide a starting point for exploring the diverse landscape of new dividend stocks and identifying opportunities that align with individual investment goals.