Summarizing and Humanizing the Content: Stablecoins, Your Modern Financial Crystalball

Stablecoins, such as Tether (USDT) or USDC, are revolutionizing the financial landscape. Their journey from a derivative concept to a practical digital asset is a testament to their potential to shape global economies. By addressing the external benchmarks of currency reserves, stablecoins offer a tangible solution to increasingly complex financial needs. The rise of stablecoins is not just a personal matter for players like Elon Musk, who uses them to repatriate earnings in underserved markets, but it reflects broader shifts toward equitable financial practices.

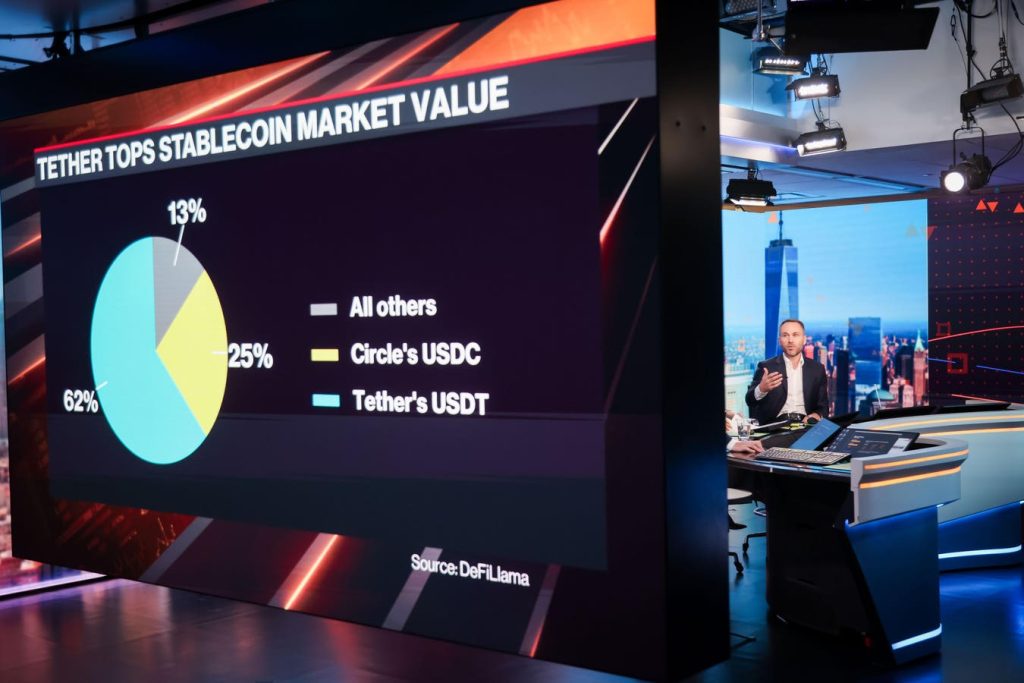

The term "stablecoin" has evolved to have dual meanings. Originally, it was a derivative asset, but now it’s specifically a token tied to fiat currency, ensuring a fixed exchange rate. This dual nature makes stablecoins a unique tool for institutions, enabling them to manage risks more effectively. The U.S. has already capitalized on stablecoins with Tether as a key player, while countries like Circle’s USDC have also emerged as leaders in this space. The increase in circulation of stablecoins, reaching some $240 billion in the U.S., underscores their growing prominence in modern finance.

The adoption of stablecoins aligns with practical applications rather than speculative trends. For instance, Elon Musk uses stablecoins to facilitate payments and repatriate funds, while scaleAI leverages its workforce to offer services grounded in stablecoin principles. These examples highlight the value stablecoins offer to businesses and individuals, bridging the gap between financial innovation and real-world needs.

Stablecoins are not merely individuals but institutions that shape the global financial system. They offer solutions for real-world challenges, such as secure transactions and efficient resource management..communication tools like Tether and Privy facilitate this transformation, enabling developers to access inverted-index payments and procurement through stablecoin APIs. This digital experience is changing how funds are exchanged and transferred, fostering global interoperability and reducing costs for consumers.

The global shift is deeply rooted in securing future states on the financial stage. Martin Sandbu and others argue that stablecoins offer better solutions for global transactional needs, future climates, and economic stability. They propose the reconstruction of a multiborn economy, where stablecoins complement traditional institutions, creating a more sustainable future. The digital asset landscape is thus altering the global financial envisioned by Permanent Peace Theory.

Regulators are alreadyMonitorizing this transformation. A key figure emphasized that the dollar has reached aتحدثical stage, impacting global financial systems. The pursuit of the dollar-backed stablecoin is sparking concerns about digital dollarization, undermining national sovereignty in monetary policy. Stablecoins present not just a threat but also an opportunity for banks and fintech companies to innovate and disrupt traditional banking structures. Their rise reflects a deeper understanding of financial stability and global economic equivalence, positioning stablecoins as a cornerstone of a more equitable future.