The Uncertain Future of Student Loan Forgiveness Under Income-Driven Repayment (IDR) Plans

The Department of Education recently announced that millions of student loan borrowers enrolled in certain income-driven repayment (IDR) plans will likely experience a payment pause extending through most of 2025. This pause stems from ongoing legal challenges to the Saving on a Valuable Education (SAVE) plan, a cornerstone of the Biden administration’s student loan relief initiatives, as well as other affected IDR plans. With the impending transition to a new presidential administration, the landscape of student loan forgiveness remains uncertain, leaving borrowers in a state of limbo regarding their repayment obligations.

The SAVE Plan and Legal Roadblocks

The SAVE plan, designed to offer more affordable repayment options and faster forgiveness timelines compared to older IDR plans, has faced significant legal opposition. A lawsuit filed by Republican-led states resulted in a court injunction blocking key features of the SAVE plan, including loan forgiveness provisions, reduced payment calculations, and interest subsidies. This injunction also impacts other IDR plans—Income Contingent Repayment (ICR) and Pay As You Earn (PAYE)—that rely on similar legal authority under the Higher Education Act. Consequently, over eight million borrowers enrolled in or applying for these affected plans have been placed in administrative forbearance, suspending their payment obligations and interest accrual.

Extended Forbearance and Implications for Borrowers

The Department of Education projects that the SAVE plan forbearance will continue until at least September 2025, with payments potentially resuming as late as December 2025. This extension is necessary to allow loan servicers to implement the required technical updates to accurately calculate monthly payments under the SAVE plan. Furthermore, annual income recertification deadlines for affected borrowers have been postponed to 2026. While the payment pause offers temporary relief, it carries a significant drawback: the forbearance period does not count towards loan forgiveness under IDR plans or the Public Service Loan Forgiveness (PSLF) program. This means that borrowers seeking loan forgiveness through these programs are essentially treading water during the forbearance, their progress towards forgiveness frozen.

Navigating the Forbearance and Exploring Alternative Options

Borrowers in the SAVE plan forbearance have several options. They can remain in forbearance, enjoying a respite from payments until the legal challenges are resolved. However, they should be aware that this pause will not contribute to their loan forgiveness progress. Alternatively, borrowers eager to continue their path towards forgiveness can switch to a different qualifying IDR plan, such as the Income-Based Repayment (IBR) plan, which is not currently affected by the court injunction blocking forgiveness. The Department of Education has reopened applications for the ICR, PAYE, and IBR plans, but warns of potential processing delays. Borrowers should also consider that while the ICR and PAYE plans are technically available, their forgiveness provisions remain blocked by the court order, whereas loan forgiveness under the IBR plan is still operational.

The Incoming Administration and Potential Policy Shifts

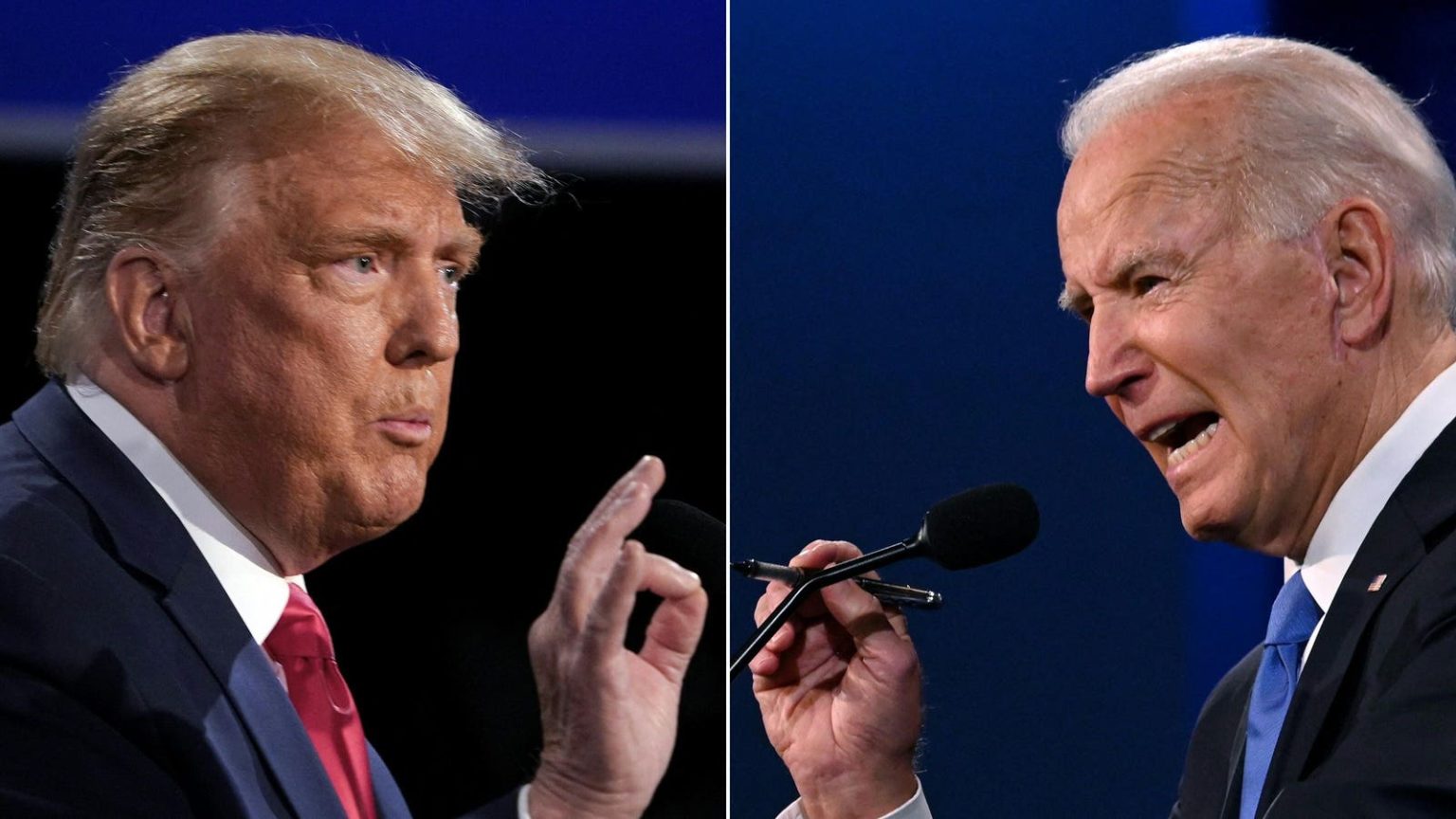

The arrival of a new administration introduces considerable uncertainty regarding the future of student loan forgiveness. The timelines outlined by the current Education Department could be subject to change, and the new administration’s policies could significantly impact existing IDR plans and loan forgiveness programs. Republican lawmakers have previously advocated for reforms to student loan programs, including potentially repealing time-based forgiveness under IDR plans. This possibility adds another layer of complexity to the already convoluted landscape of student loan repayment.

The Path Forward for Borrowers

With the legal battles continuing and a new administration poised to take office, borrowers enrolled in affected IDR plans face a period of uncertainty. They must carefully weigh their options, considering the implications of remaining in forbearance versus switching to a different plan. Staying informed about updates from the Department of Education, court rulings, and potential legislative changes will be crucial for borrowers to make informed decisions about their student loan repayment strategies. The coming months will likely bring further clarity to the future of student loan forgiveness, and borrowers should be prepared to adapt to evolving policies and circumstances.