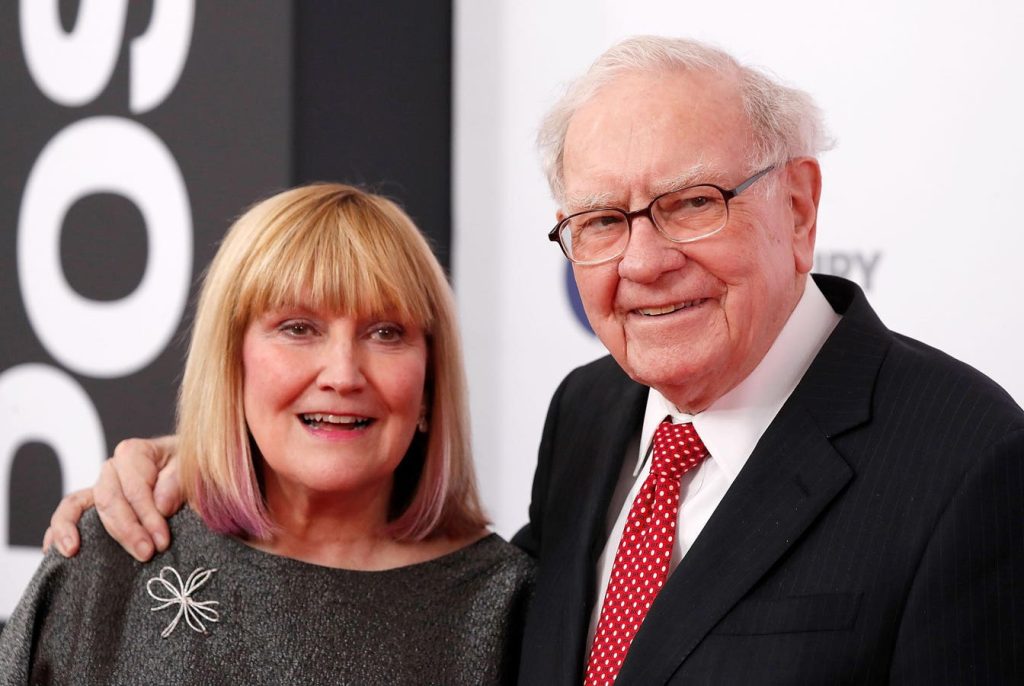

In his 2024 letter to Berkshire Hathaway shareholders, Warren Buffett sparked discussion among estate planning professionals by advocating for adults to share their estate plans with their children prior to finalizing them. This approach aims to foster transparency and trust between parents and their children, potentially mitigating misunderstandings that can lead to conflict following a parent’s passing. However, estate professionals caution against this practice, as it could introduce issues such as family disputes, undue influence from heirs, and a loss of flexibility in decision-making. For families dealing with complex estates, which may include businesses, valuable artwork, or inheritances that carry emotional weight, this recommendation warrants careful deliberation.

The primary benefit of sharing estate plans lies in its potential to foster transparency and trust within families. Behavioral economics suggests that open communication alleviates uncertainty and anxiety, making it easier for parents to convey their intentions. By engaging in discussions about their estate plans, parents can ensure clarity, which significantly reduces the risk of misunderstandings about asset distribution. Such transparency not only preserves familial harmony but also strengthens bonds among family members, allowing for deeper conversations surrounding shared values and legacy. In essence, these discussions can pave the way for a more united family front, reinforcing relationships and a sense of purpose.

However, there is a significant counterargument to consider, which lies in the risks associated with premature sharing of estate plans. One primary concern is the potential for conflict among family members, as knowledge of asset distribution could lead to disputes if there are differing perspectives on how assets should be managed or inherited. Furthermore, once adult children are privy to the estate plans, they might exert undue pressure on their parents to change their decisions, which could diverge from the parents’ original wishes. The act of sharing information too early may also create a sense of rigidity, impeding parents’ ability to adjust their plans as family dynamics evolve over time, thereby complicating future decisions.

Complicating matters further, families with unique or complex assets face additional challenges that arise from sharing estate plans. For instance, emotional ties to significant assets—like family businesses or valuable artworks—can intensify potential disagreements over inheritances. Valuation disputes may emerge, particularly if family members perceive unfairness or bias in the asset assessment. If parents divulge their succession plans for a family business, this might inadvertently disrupt operations or damage workplace relationships, further muddying the waters of estate planning and inheritance dynamics.

In light of the complexities surrounding estate planning, employing the Strategy and Tactic (S&T) Tree decision-making framework can be beneficial for families contemplating Warren Buffett’s advice. The S&T Tree encourages stakeholders to clarify their overarching goals—such as maintaining a profitable family business—while identifying intermediate objectives, strategies, and tactical actions necessary to achieve these goals. For instance, a family that owns a manufacturing company might establish job descriptions, performance metrics, and a buy-sell agreement to facilitate a smooth succession, thereby minimizing potential rifts among siblings and ensuring capable leadership.

Ultimately, while Buffett’s principles echo a cultural preference for transparency, families must weigh these practices against the potential risks inherent in sharing estate plans. The decision is not one-size-fits-all; rather, it should be tailored to each family’s unique dynamics and asset complexities. Utilizing structured frameworks like the S&T Tree enables families and their advisors to create thoughtful, data-driven plans that long-term balance openness with discretion. For families navigating the intricacies of estate planning, this systematic approach can serve as a guide, steering them toward the preservation of their legacies without sacrificing familial unity or flexibility in decision-making. Thus, while the conversation surrounding estate plans should not be neglected, it requires a careful, nuanced approach that aligns with long-term family values and goals.