The Illusion of Expertise: A Deep Dive into Analyst Stock Predictions

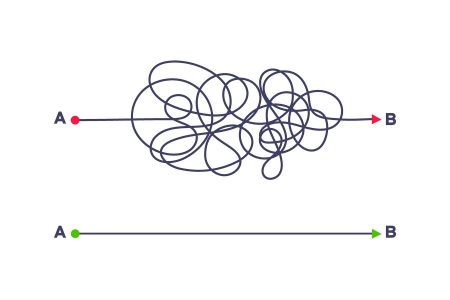

The world of finance often portrays analysts as oracles of the stock market, equipped with sophisticated models and insider access to predict the future movements of stock prices. They engage in meticulous research, dissect company financials, and conduct in-depth interviews with management to uncover hidden gems and identify potential pitfalls. However, a longitudinal study spanning over a quarter of a century reveals a less glamorous reality: analysts’ ability to pick winning stocks is no better than chance, often lagging behind even the broader market indices.

This long-term study meticulously tracks the performance of stocks most loved and most hated by analysts. Each January, the four stocks receiving the highest number of ‘buy’ recommendations and the four with the most ‘sell’ recommendations are identified. Their subsequent performance throughout the year is then compared to the benchmark S&P 500 Total Return Index. The results, compiled over 26 years (excluding 2008), consistently demonstrate a lack of predictive power among analysts. The analysts’ favored stocks have averaged a 7.25% annual return, while the despised stocks have yielded a slightly lower but comparable 6.89% return. Both groups significantly underperform the S&P 500, which boasts a 12.57% average annual return during the same period.

The year 2024 serves as a compelling microcosm of this broader trend. Schlumberger, the analysts’ darling, experienced a dramatic 24.4% decline. While Targa Resources, another favored stock, soared by an impressive 110.1%, the overall performance of the analysts’ picks was dragged down by the poor performance of other favorites. Conversely, the stocks analysts shunned, collectively deemed the "hated brigade," delivered a respectable 16.9% return, exceeding the broader market and significantly outperforming the analysts’ favorites. This pattern, replicated across multiple years, challenges the notion of analyst expertise in stock picking.

Over the 26 years of the study, the analysts’ preferred stocks have outperformed their despised picks only 14 times, while the despised picks have emerged victorious 11 times, with one tie. Furthermore, neither group has consistently outperformed the broader market. The analysts’ favored stocks have beaten the S&P 500 only seven times, while the despised stocks have surpassed it ten times. These results highlight the inherent unpredictability of the stock market and the limitations of even the most sophisticated analysis. The data underscores the fact that analyst sentiment, while potentially influential in short-term price movements, does not reliably translate into superior long-term returns.

As 2025 begins, the analysts’ affection has gravitated towards airline stocks, with United Airlines and Delta Air Lines receiving overwhelmingly positive ratings. This optimism stems from the resurgence in air travel and relatively stable fuel prices. However, history suggests caution. The airline industry, notoriously volatile and subject to unpredictable external factors, remains a risky bet, even with seemingly favorable conditions.

Beyond airlines, analysts are also enamored with biotech companies like Arcelix and Axsome Therapeutics. While these companies pursue laudable goals in developing innovative therapies, their valuations appear stretched compared to their current revenues. Moreover, insider selling activity raises further concerns about the sustainability of their current stock prices. Such discrepancies between market valuations and underlying fundamentals highlight the potential for speculative bubbles and the importance of scrutinizing analyst recommendations.

On the other side of the spectrum, analysts express strong aversion towards companies like ZIM Integrated Shipping Services, Ginko Bioworks Holdings, CNX Resources, and AMC Networks. These companies face challenges such as declining revenues, persistent losses, and uncertain future prospects. While their current valuations may appear low, the underlying business fundamentals suggest a continued struggle for profitability. However, the historical data from the study suggests that even these "despised" stocks may offer surprising returns, further underscoring the difficulty in predicting market movements.

The persistent gap between analyst predictions and actual market performance raises fundamental questions about the value of analyst research. While analysts play a vital role in disseminating information and facilitating market transactions, their ability to consistently identify winning stocks remains elusive. The findings of this long-term study suggest that investors should exercise caution when interpreting analyst recommendations and prioritize independent research and a diversified investment strategy. The stock market, with its inherent volatility and unpredictable nature, often defies even the most sophisticated analytical tools. The lesson here is clear: relying solely on analyst sentiment can be a dangerous game, and prudent investors should always conduct their due diligence before making investment decisions.