The Elusive Definition and Evolution of Insider Trading

Insider trading, a term often misunderstood and lacking a concrete statutory definition, generally refers to the practice of trading stocks or securities based on material, non-public information. Its legal framework emerged following the 1929 stock market crash, with the Securities Act of 1933 and the Securities Exchange Act of 1934 aiming to curb market abuses. The SEC’s Rule 10b-5, clarifying Section 10(b) of the 1934 Act, subsequently prohibited fraudulent activities related to securities trading. However, the precise meaning of "insider" and the circumstances constituting illegality have remained subject to judicial interpretation and have evolved over time. The 2016 Supreme Court case Salman v. United States solidified the concept of "tipper-tippee" liability, holding individuals accountable for trading on information received from insiders, even without direct quid pro quo, if they knew or should have known the information was confidential and material.

High-Profile Cases and the Face of Insider Trading

Several prominent cases have shaped public perception of insider trading, though not all involved direct charges of this offense. Martha Stewart, a notable example, was convicted of obstruction of justice and lying to investigators related to her sale of ImClone Systems stock, not insider trading itself. Raj Rajaratnam, a hedge fund manager, received an 11-year sentence for orchestrating a network of corporate insiders providing him with confidential information. Ivan Boesky, whose pronouncements on greed inspired the iconic "Wall Street" character Gordon Gekko, served a three-year sentence and paid a substantial fine for profiting from information gleaned from investment bankers. The SAC Capital case, involving founder Steven Cohen, resulted in the firm pleading guilty to insider trading and paying a hefty penalty, while employee Matthew Martoma was convicted for his role in acquiring confidential information from doctors involved in drug development. While Cohen himself faced regulatory sanctions, he avoided criminal charges.

The Bharara Era and the Unprosecuted Meltdown

Preet Bharara, as U.S. Attorney for the Southern District of New York, spearheaded an aggressive campaign against insider trading, securing convictions in the vast majority of cases he pursued. Ironically, this zeal did not extend to the perpetrators of the 2008 financial crisis, with no major executives facing criminal charges for their roles in the subprime mortgage debacle that devastated the economy. This disparity raises questions about the selective application of justice and the true targets of insider trading enforcement. Does the focus on individual insider trading cases overshadow the systemic risks posed by unchecked corporate greed and regulatory failures?

The Case for Legalizing Insider Trading: A Contrarian View

Despite the prevailing condemnation of insider trading, arguments for its legalization persist. Proponents suggest it can serve as a form of compensation for lower-paid employees, benefiting both individuals and companies. They also argue it is a victimless crime, unlike the 2008 crisis, where no direct financial losses are incurred by stockholders or companies. The cost and time involved in prosecuting these cases, with arguably limited public benefit, further fuel this perspective. Perhaps the most compelling argument centers on market efficiency. Legalizing insider trading, proponents contend, could accelerate the incorporation of non-public information into stock prices, leading to a more accurate reflection of a company’s true value.

Maintaining the Prohibition: The Argument for Fairness and Market Integrity

The primary justification for criminalizing insider trading rests on the principle of fair market access. Opponents of legalization argue that allowing insiders to profit from privileged information undermines investor confidence and discourages participation in the stock market. This, they claim, would lead to reduced capital investment and ultimately harm the economy. However, this argument’s strength is questionable when considering the dominance of institutional investors, comprising around 90% of stock trades. These sophisticated players, with their extensive research capabilities, are less likely to be deterred by the presence of insider trading.

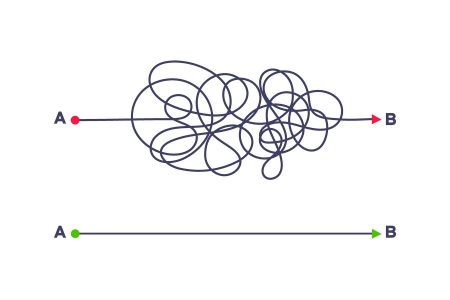

Balancing Competing Interests: A Path Forward

The debate surrounding insider trading reflects a complex interplay of competing interests. While preventing unfair advantage and maintaining market integrity are crucial, the arguments for legalization, particularly regarding market efficiency and the potential for alternative compensation models, cannot be dismissed outright. Perhaps a more nuanced approach is needed, one that recognizes the varying degrees of insider trading and differentiates between egregious abuses and more benign instances. A clear and comprehensive statutory definition of insider trading, along with a reassessment of enforcement priorities, could help address the ambiguities and inconsistencies that currently plague this area of law. Furthermore, examining the broader context of financial crimes and ensuring that regulatory oversight addresses systemic risks, rather than focusing solely on individual cases, is essential for promoting a truly fair and efficient market.