Understanding the Chaotic Year 2025: A Tory’s Perspective on Financial Ambiguity

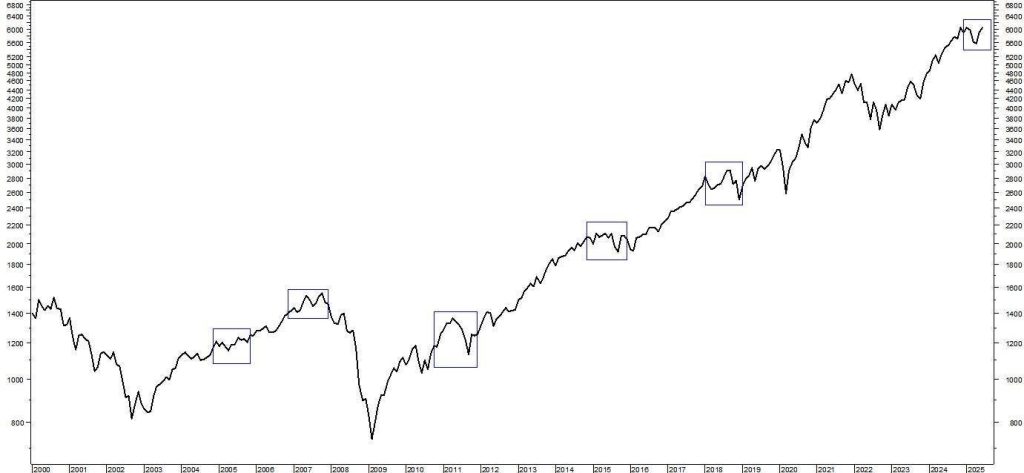

The 2025 financial landscape is a decade divided by uncertainty, marked by both expectation of profit and consternation at losses. Since 2000, analysts have noted rare instances where stock market gains were dpaired with significant losses, often referred to as "whipsaw years." These events typically occur alongside investor panic and market corrections, creating an uneven return profile.

Historically, 2025 has seen five periods with at most a one-per cent return, but excluding the financial crisis of 2007, several of these periods came across as a negative outcome. The recalibration of expectations post-pandemic suggests that the year ahead may be as unpredictable as it was past 2000, presenting a testing challenge for long-term investment strategies.

Investors must possess a profound understanding of market dynamics to navigate these challenges, as the financial markets rarely reward aggressive buying-and-selling tactics. The true strength of a stock often lies in its ability to rise during sideways moves or sustain dominance during bear markets. Identifying such opportunities, particularly in sectors like steel and alloy, which historically exhibit superior performance in the post-crisis period, is a crucial skill.

The stock market repeats past "whipsaw" years, each presenting new opportunities and pitfalls. While the financial landscape is likely to evolve independently of past performance, investors must remain vigilant and adjust their strategies as circumstances change. Regular monitoring of market trends and volatility, coupled with knowledge of inverse market hedges and ill conviction against traditional strategies, can help manage expectations.

A common pitfall during market culprits like Joyful Group is the "sell low and buy high" strategy. Traders may miss the selling opportunities and fail to profit from the subsequent market rally, leading to significant losses. Avoiding this pitfall requires disciplined investment discipline and a focus on clear identify winners and losers during volatile periods.

Moreover, the concept of a "stock picker" during sideways markets offers potential profitability through investments in undervalued or high-growth sectors. Industries like steel and alloy, historically outperforming certain tech sectors during times of recovery, have shown robust growth potential, making them a valuable avenue for disciplined investors.

Lastly, the Wall Street observation "Don’t confuse brains with a bull market" serves as a cautionary tale for investors, emphasizing the importance of diversification, thorough research, and evolving market awareness. Adhering to this aphorism underscores the extreme unpredictability of the financial markets and the need for a flexible approach to strategy.

In conclusion, the financial landscape of 2025 is poised to be a challenging yet fascinating period, where the ability to adapt and reinvest profits wisely will be critical to long-term success.