Navigating the Exuberance and Risks of a Potential Market Bubble

The investment landscape of 2024 has been marked by a remarkable surge in the S&P 500, reaching a 36% year-over-year increase by September. This exceptional performance, largely fueled by the dominance of US Large Cap Growth stocks, has created a palpable sense of FOMO (Fear Of Missing Out) among investors, even those with a traditionally conservative approach. The allure of double-digit returns, defying conventional investment wisdom and projections by established firms like JP Morgan, has led many to question their current strategies and seek higher-growth opportunities. This poses a dilemma for investors: how to participate in this potential boom while mitigating the risks associated with an increasingly frothy market.

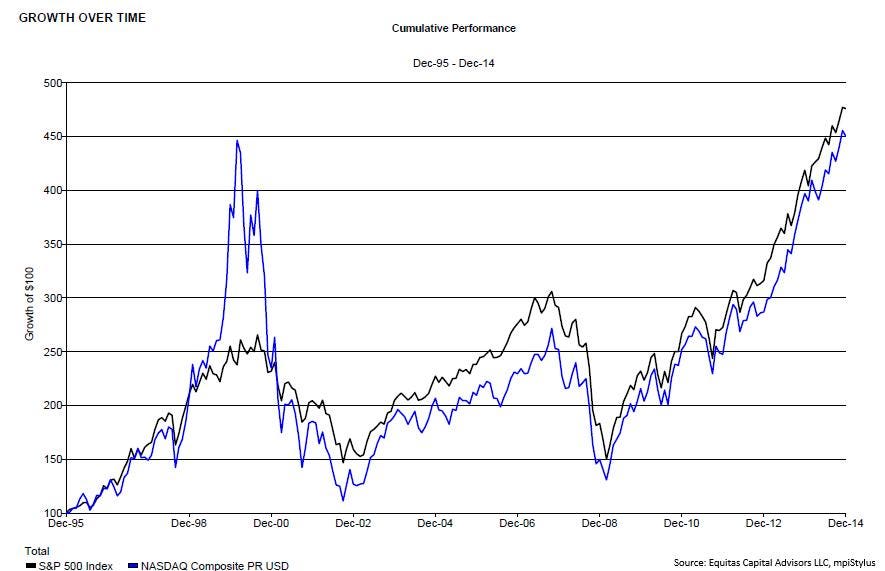

The unprecedented growth of Large Cap Growth stocks, driven primarily by advancements in technology, particularly the ongoing AI revolution, has far surpassed expectations. This phenomenon raises the question of sustainability and the potential for a market correction. Historical precedents, such as the railroad boom of the 1840s, the dot-com bubble of the 1990s, and the smartphone surge of the 2010s, all illustrate the cyclical nature of transformative technologies. These cycles typically progress through stages of innovation, adoption, euphoria, bubble formation, and eventual correction. Understanding where we are in this cycle is crucial for making informed investment decisions.

The parallels between the current market and the dot-com era are particularly striking. While the Nasdaq’s current forward price-to-earnings ratio (P/E) of around 27 is lower than the peaks of the dot-com bubble, it remains significantly above the historical average of 20. This elevated valuation, coupled with the massive influx of capital into tech-focused ETFs and individual stocks with exorbitant P/E ratios, points to a potentially overheated market. The $26 billion poured into the Nasdaq ETF (QQQ) in 2024 alone, alongside the proliferation of AI, cryptocurrency, and hyper-growth ETFs, many launched within the past year, further underscores the speculative fervor gripping the market. Examples like Gilead Sciences and Palantir, with P/E ratios exceeding 500, highlight the extreme valuations prevalent in certain segments of the market.

The challenge for investors is to balance the potential for continued growth with the very real risk of a significant market correction. While the underlying momentum driving the current tech boom remains strong, the signs of a potential bubble are increasingly evident. The key to successfully navigating this environment lies in maintaining a degree of exposure to growth opportunities while simultaneously implementing safeguards to mitigate the inevitable market excesses. A disciplined and balanced approach is essential to avoid being caught on the wrong side of a potential bubble burst, which history has shown can have devastating long-term consequences for portfolios.

Equitas Capital Advisors, LLC, founded in 2002, offers a unique approach to investment management, combining the resources of a large corporation with the agility of a boutique firm. We believe in "Engineering Financial Solutions®" tailored to the specific needs and objectives of our diverse clientele, which includes foundations, endowments, insurance companies, universities, corporate retirement plans, and high-net-worth family offices. Our team boasts over 200 years of combined investment management consulting experience. We understand the complexities and uncertainties of the current market environment and have developed comprehensive frameworks for evaluating AI and technology investments, going beyond the hype and headlines.

Our proprietary Navigator system incorporates both technical and fundamental analysis to dynamically adjust client portfolios between high-risk growth investments and safer havens. This systematic approach allows us to participate in the potential upside of the technology revolution while mitigating downside risks. We recognize that achieving the right balance between growth and protection is paramount in this volatile market. If you are interested in learning more about our disciplined and systematic approach to managing technology exposure, we invite you to contact us. We are committed to helping our clients navigate the complexities of the current market and achieve their long-term financial goals. Please note the important disclosures and disclaimers provided in the original text regarding the illustrative nature of the information, investment risks, past performance not being indicative of future results, and the limitations of diversification and asset allocation strategies.