The recent volatility in quantum computing stocks has sparked debate, drawing comparisons to both a speculative bubble and the nascent stages of artificial intelligence. The core question revolves around the technology’s potential: can quantum computing truly disrupt classical computing, and if so, when? This uncertainty fuels speculation, driven by both investor instinct and pronouncements from tech luminaries, some of whom may have vested interests in downplaying the potential threat to their current businesses. Nvidia, a dominant player in the AI chip market, serves as a prime example. While their GPUs have enabled exponential growth in AI, quantum computing’s theoretical “double exponential” speedup, known as Neven’s law, poses a potential existential threat. This makes Nvidia’s public stance on quantum computing delicate, as acknowledging its disruptive potential could undermine their current market dominance.

The timeline for practical quantum computing remains elusive. While nature itself can be considered a quantum computer, replicating its computational power artificially presents significant challenges. The history of technological innovation, however, suggests that seemingly insurmountable obstacles can be overcome rapidly, especially when driven by competitive forces. The development of flight serves as an analogy: humans didn’t learn to fly by mimicking birds but by understanding and applying the principles of aerodynamics. Similarly, quantum computing requires a new paradigm, distinct from classical approaches, and its potential impact cannot be extrapolated from current computational models. The concept of “quantum supremacy,” where quantum computers solve problems intractable for classical computers, has moved from theoretical possibility to experimental demonstration, shifting the focus from feasibility to overcoming technical hurdles like error correction. Nvidia’s recent “Quantum Day” announcement further underscores the intensifying commercial race in this field.

Investing in quantum computing stocks carries considerable risk, akin to speculating on early-stage AI, dot-com companies, or Bitcoin. However, the potential for substantial returns warrants a measured allocation to such moonshot investments. Predicting the precise trajectory of these investments is nearly impossible, resembling a biased coin flip experiment. The probability of success, “p,” determines the expected value, which remains low for highly speculative ventures. This low expected value, however, is coupled with high skewness and kurtosis, meaning the distribution of potential outcomes is asymmetric with a “fat tail” representing the possibility of outsized gains. This characteristic, reminiscent of lottery tickets or Bitcoin’s historical performance, can lead to life-changing returns if the entry price is sufficiently low.

The key to navigating these high-risk, high-reward investments lies in proper position sizing. The mathematics of biased coin-flip betting, which underpins option pricing theory, provides a framework for understanding optimal allocation. The Kelly criterion offers a simplified formula for calculating the optimal investment fraction, balancing the probability of success, “p,” with the potential payoff, “b.” Applying this framework to quantum computing, assuming a potential 100-to-1 payoff and a 5% probability of success, suggests an optimal allocation of around 4% of the portfolio. This framework highlights the importance of a high potential payoff to justify even a small investment, especially when the probability of success is low. Furthermore, diversifying across various quantum computing technologies and companies is crucial given the uncertainty surrounding which approach will ultimately prevail.

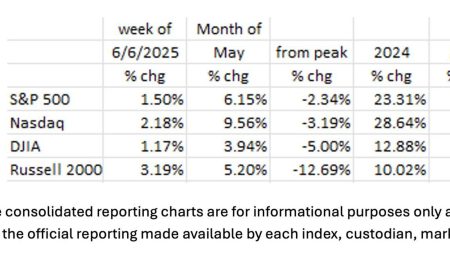

The recent price volatility in quantum computing stocks, triggered by a single comment from Nvidia’s CEO, underscores the importance of proper sizing. Overly large or leveraged positions can force investors out at inopportune times, creating buying opportunities for those with smaller, more manageable exposures. The ability to withstand such volatility and hold onto positions, often referred to as “HODL” in cryptocurrency circles, is crucial for realizing the potential upside. Ultimately, managing risk through appropriate sizing is paramount in speculative investments like quantum computing stocks.

In conclusion, while quantum computing remains a high-risk investment, its potential for transformative impact warrants consideration. A small, diversified allocation, guided by principles like the Kelly criterion and a focus on managing risk through proper sizing, can balance the low probability of success with the potential for outsized returns. The key is to be “in it to win it,” but with a carefully calibrated exposure to avoid being shaken out by inevitable market fluctuations. The focus should be on capturing the potential upside, skewness, and kurtosis, recognizing that while catastrophic losses are possible, so too are life-changing gains. This approach allows for participation in the potential revolution without risking financial ruin.