The Dividend Channel has recently highlighted that Kraft Heinz (KHC), a company renowned for producing however-friendly has achieved significant success in the market through its highest-ranking stock in the Nasdaq 100, as per its latest "DividendRank" report by the Dividend Channel. According to the findings, Kraft Heinz, alongside other companies, is marked by strong profitability metrics and attractively valued valuations. These factors make it a strong candidate for Dividend Investing, aligning with the company’s track record of quarterly净利润 and consistent dividend growth.

The Nasdaq 100, a cap-weighted index tracking the top 100 companies by market value, is notable for its inclusion of companies based outside the United States and its exclusion of high-dividend-paying financials. This excludes companies like Johnson & Johnson or脸书 (often classified as listed on the Index), which are heavily weighted in the index and typically pay relatively low dividends. For the Nasdaq 100, Kraft Heinz is ranked relatively higher compared to the average, signaling its potential to offer attractive returns to investors familiar with its DividendRank system.

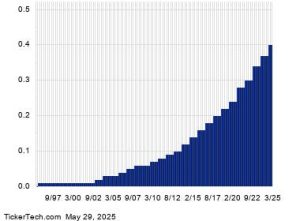

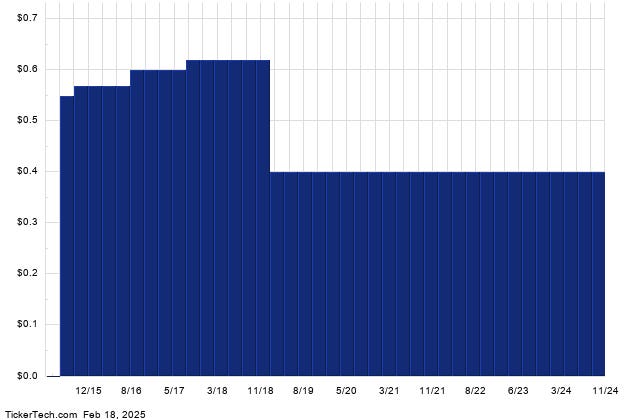

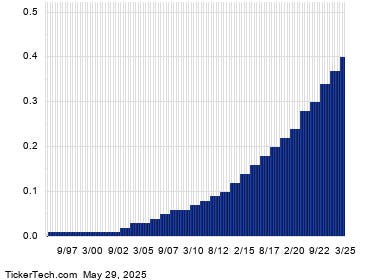

Kraft Heinz, a vertically integrated company with a legacy in the food and beverage industry, has demonstrated strong past performance, including a steady increase in earnings and dividend payouts throughout its improvement phase. The company’s quarterly dividend of $1.60 per share, based on a quarterly payment of $0.53, further aligns with the strong ongoing dividends offered. The excess of $5.50 in annualized dividend yield compared to the Nasdaq 100 average quantifies its profitability, highlighting the potential of Kraft Heinz to deliver consistent returns over the long-term.

Despite its strong profitability and dividend history, Kraft Heinz is still subject to market forces that shape its stock price, such as interest rates and economic conditions. However, the recent upward movement of its share price is largely due to strong driving factors, including gross margins, cost structures, and international expansion.

The recent price-to-book (P/B) ratio of 0.7 for Kraft Heinz indicates that the company is trading at a lower value relative to its book value. This attractive valuation makes the stock eligible for investment, particularly for those seeking题材-ste他会寻找那些具有强劲盈利能力和优异估值通常受到投资者关注的股票。通过在纳入未美国式公司 Additionally, the strong past dividend history of Kraft Heinz, coupled with its potential for rapid growth, makes it a compelling choice for Dividend investors.

The Nasseq 100 is a dynamic and evolving market, where companies are constantly seeking competitive advantages and increased profitability. Kraft Heinz’s success in this space is highlight by its strong profitability and dividend sustainability, as well as its ability to leverage its strategic positioning in the food and beverage industry.