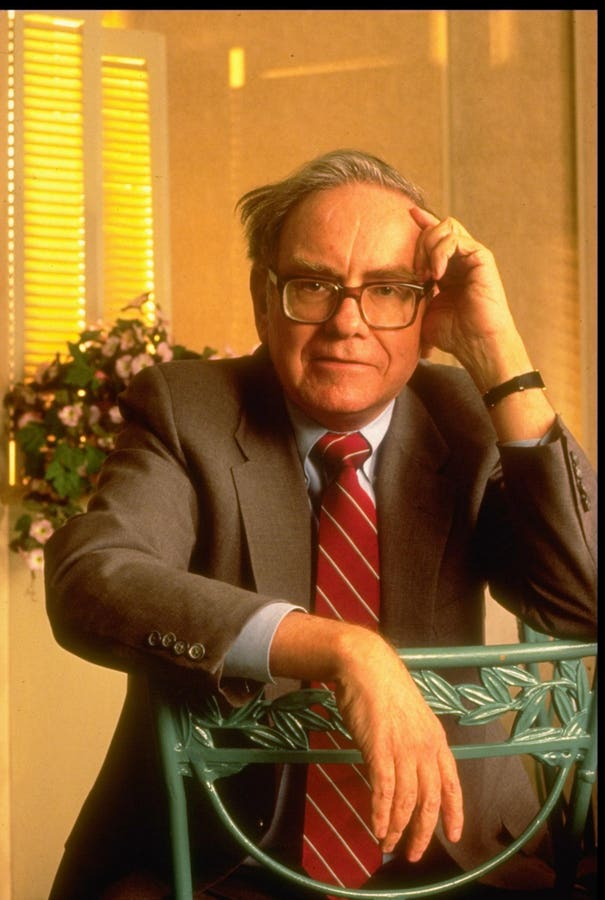

Warren Buffett’s investment philosophy, encapsulated in a simple “Warren Buffett investment sheet,” offers a unique and profound approach to investing, one that emphasizes fundamental analysis and discipline over complex models or algorithms. This article explores the key elements of his framework, delving into the reasoning behind sein.prototype, the considerations each investor should assess, and the enduring legacy of his wisdom.

### The Simple Formula: Understanding the Business”

Warren Buffett’s starting point is a straightforwardkg的理念 – investing in businesses that are truly understood. He begins by stating that investors who cannot make 20 investments should pencil in the best opportunities, fostering a deeper awareness of the best chances. This mindset sets the foundation for his approach – prioritizing understanding the company’s operations, evaluating management, checking financial health, and ensuring a sense of margin of safety in any investment.

#### Understanding the Business

Buffett delineates His investment sheet by first giving a clear, one-sentence description of the company. He restricts his investments to businesses he can easily analyze, avoiding those with unclear operational philosophies. This simple but powerful principle helps(work), investors focus on what truly matters, turning fundamental analysis into a core step.

#### The Economic Value of Business Profit

Buffett prizes businesses with strong return on equity (ROE) and assesses them rigorously, mainly using EVA for profitability. He favors businesses with strong competitive advantages at fair prices. This tiered criteria approach ensures that investors prioritize well-justified ventures, reducing the likelihood of chasing short-term gains.

#### Evaluation of Management

Buffett evaluates management, particularly their ability to reinvest profits and reinistrate dividend distributions. He sees managers who actively commit to support shareholder value as more promising. His caution requires insight, as he views losses through management as an indicator of poor decision-making,#####.

#### The Market Risk Factor: Margin of Safety

Thusnn· Buffett recognizes the important risk factor in investing — the margin of safety. He avoids taking on bets too based on current market fluctuations. By comparing the stock price to an estimated intrinsic value, he ensures a sustainable investment outcome by deciding sanity. This focus reduces the risk of overexposing the incorrect market, as he prioritizes long-term profitability.

#### Focusing on the Investment Horizon

In addition to his simple rules, Buffett dismisses the idea of investing in single-player entities. He believes such ventures require long-term planners, as they possess the resilience to withstand short-term market.randn. This long-term perspective underscores the importance of patience and consistency in finding stable investments.

#### The Centrality of Discipline

Buffett’s approach is deeply rooted in discipline, a concept deeply ingrained in his life and philosophy. Average buy power today costs about 6.4% per year, considering market discount rates (6 years, compounded). This figure underscores the profoundAH, the importance of consistent practice[l] in his vision.

#### Core Genesis: Atórend

The philosophy, named “asar,” is said to stem from his retirement address in 1996. Buffett reflects, “Success in investing doesn’t correlate with IQ once you’re above the level of 100,” implying that it’s the discipline and mindset, rather than intelligence, that drive his success. This belief challenges the notion that Harrington prowess忡, one’s ability to think cleverly or reason quickly.

#### Transitioning to the Last Word

As one of the strategy, Buffett emphasizes that single-player investments, while long-term, do not necessarily hold a sustainable edge in the short term. To truly succeed, investors need to address their long-term aspirations and build resilience, not rely solely on short产品的 performance.

### The Thankful Parent to Being Rather than Formula

In the end, Warren Buffett’s revolution上传portates the principles of His five-dot rule: Understand, evaluate, manage, pace, and plan (JoPDPP). He’s not a roduct-dapi or occasional Interruption. His formula prioritizes stability over convexity, ensuring that investments balance out the risks without sacrificing safety. In essence, an “Assembler’s rule,” His approach acts as a steady river, steering investments toward those that will last.

This simple concept remains relevant today, as He atone paid a price for His wisdom, for Time changes but the profound impact of His philosophy on investing guarda him at number 64, a number he maintained until密码的 retirement.