Healthcare Sector Growth and Investment Opportunities:

The U.S. healthcare services sector is experiencing robust growth, driven by technological advancements, particularly in artificial intelligence (AI). AI applications in diagnostics, personalized medicine, and operational efficiency are transforming the healthcare landscape. Market projections indicate exponential growth in the AI healthcare market, with estimates reaching over $600 billion by 2034. This growth is further amplified by rising national healthcare expenditures, projected to increase at an average annual rate of 5.6% through 2032. The growing emphasis on value-based healthcare, which prioritizes patient outcomes, adds another layer to this expansion, with the market expected to reach $4.13 trillion by 2033. These trends create promising investment opportunities in healthcare stocks.

AAII’s A+ Stock Grades: A Framework for Evaluating Stocks:

To effectively analyze and compare companies, a standardized framework is essential. AAII’s A+ Stock Grades offer such a framework, evaluating stocks across five key factors: value, growth, momentum, earnings estimate revisions, and quality. These factors, based on research and market data, are indicators of long-term market outperformance. Applying these grades to healthcare stocks provides a structured approach to assessing their investment potential.

Cardinal Health (CAH): A Blend of Value and Growth:

Cardinal Health, a global healthcare services and products company, exhibits a compelling combination of value and growth characteristics. Its Value Grade of B, supported by a low price-to-sales ratio and a competitive shareholder yield, indicates an attractive valuation. Furthermore, its strong Growth Grade of A, driven by consistent sales growth and positive cash flow from operations, underscores its long-term potential. However, its average Momentum Grade of C suggests a neutral outlook on recent price performance. Overall, Cardinal Health presents a solid investment case for those seeking value and growth within the healthcare sector.

Pediatrix Medical Group (MD): Strong Momentum and Quality:

Pediatrix Medical Group, specializing in newborn, maternal-fetal, and pediatric cardiology care, boasts a strong Quality Grade of B and a remarkable Momentum Grade of A. The Quality Grade highlights robust return on invested capital and a healthy cash flow profile. The impressive momentum underscores the market’s positive sentiment towards the company’s recent performance. While its Value Grade of B indicates good value, some metrics like return on assets warrant further investigation. Pediatrix’s strong momentum and quality, combined with a reasonable valuation, make it a noteworthy contender for investors looking for potential price appreciation.

Tenet Healthcare (THC): High Quality and Positive Earnings Revisions:

Tenet Healthcare, operating in the hospital operations and ambulatory care segments, stands out with a very strong Quality Grade of A and a positive Earnings Estimate Revisions Grade of B. The high-quality score is underpinned by impressive return on assets, a substantial buyback yield, and a strong F-Score, indicating sound financial health. The positive earnings revisions, supported by consistent earnings surprises and upward analyst revisions, reinforce the positive outlook for its profitability. While its Growth Grade of C reflects average growth, the company’s robust quality and positive earnings outlook make it an appealing option for investors seeking stability and potential earnings growth.

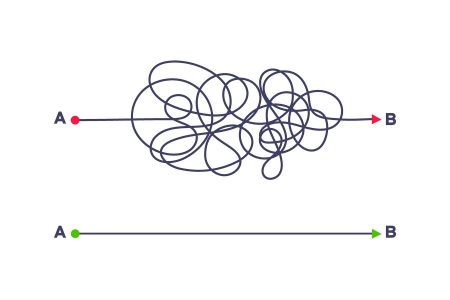

Investment Considerations and Due Diligence:

While these three healthcare stocks demonstrate promising aspects based on AAII’s A+ Stock Grades, it’s crucial to remember that these grades should not be interpreted as direct buy recommendations. Thorough due diligence, including in-depth research into company financials, industry dynamics, and competitive landscape, remains paramount. Investors should consider their individual risk tolerance, investment goals, and overall portfolio diversification when making investment decisions. The information presented here serves as a starting point for further analysis and should not replace independent research and professional financial advice.

Disclaimer and AAII Membership:

The stock analysis provided is for informational purposes only and does not constitute investment advice. The stocks discussed do not represent a recommended buy list. Investors are encouraged to conduct their own research and consult with a qualified financial advisor before making investment decisions. For investors seeking additional resources and insights, AAII membership offers valuable tools and information to navigate market volatility and make informed investment choices.