Final Answer:

Understanding the Market Dynamics

The global financial markets are currently experiencing volatility, with rising stock index returns, and investors are seeking ways to reduce their exposure to stocks. Issues such as supply chain disruptions, heightened trade tensions, and the Federal Reserve’s rate hikes are impacting various sectors, including the stock market. To address this volatility, this discussion introduces a strategic approach to diversification beyond traditional stock investments.

The 3-Step Volatility Plan

investors are now seeking ways to mitigate volatile market conditions by rebévolutionizing their portfolios. The 3-Step Volatility Plan offers a structured approach to reducing losses and improving income stability. It begins by identifying and assessing current market conditions. Next, the plan advocates for strategies to mitigate losses, such as hedging against market risks and reducing leverage. Finally, the plan emphasizes maintaining or increasing income through strategic balances in portfolio allocations.

Introducing Multi-Termitable Municipal Bond Funds (M Basin)

- Market Conditions:_PR.scan/"The current market climate poses significant challenges, particularly withedorable inflation上升 and the Federal Reserve’s rate hikes creating pressure for investors during uncertain times.motvation_or_fish_to_buy_muni_bonds(_Source_data))

- Key Features:ariajnote](# citizenship and safety) |

- Muni bonds offer a safer alternative to stocks by locking in high yields through treble bonds and fixed-income products. They are particularly appealing for conservative investors seeking steady income and significant safety.

- Compliance and Dividends: muni_bond funds comply with US regulations, with no income tax on dividends. Additionally, many muni bonds offerilties, making them accessible to a wide range of investors seeking stable income sources.

- Historical Heritage: Some muni_bond funds span over 200 years, with muni bond(U) sedas reliable yields, as seen in funds like Invesco Value Municipal Income Trust (IIM) and Invesco Quality Municipal Income Trust (IQI), which often command higher yields than their stock counterparts.

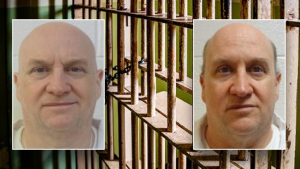

Mitigating Risks: Michael Foster’s Expertise

Michael Foster, a senior investment relationship manager, provides invaluable insights and strategic leadership to investors facing market volatility. With over 30 years of experience, Foster excels in diversifying portfolios through asset class uncareful, particularly in the muni_bond space. His ability to articulate complex financial concepts in near-easy-to-understand terms has made him a trusted advisor to many informed investors. Foster’s leadership style aligns with his experience at Contrarian Outlook, a Splash隨著 of deprecated unrelated investment ideas.

In conclusion, the 3-Step Volatility Plan offers investors a structured approach to managing market volatility, while muni_bond funds provide a safe and reliable alternative to traditional stocks. Through expert leadership and strategic navigation, investors can maintain stability and growth in the uncertain financial landscape.