The Defense Sector: A Promising Investment Landscape in 2025 and Beyond

The global defense sector is poised for robust growth, driven by escalating geopolitical tensions and a renewed focus on military preparedness. This positive outlook is further reinforced by the pro-defense stance of the current US administration, although potential budgetary constraints could pose a challenge. For investors seeking opportunities within this expanding market, defense stocks offer a compelling avenue for portfolio diversification and potential capital appreciation. Identifying companies with consistent revenue growth, strong operating margins, and innovative product offerings is key to capitalizing on this trend.

Methodology for Selecting Defense Stocks

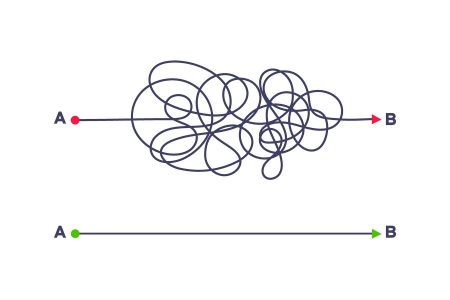

The selection of promising defense stocks for this analysis hinges on three key criteria: consistent revenue growth exceeding 5% over a three-year period, sustained revenue growth for at least three consecutive years, and operating margins above 10%. These metrics provide insights into a company’s financial strength, operational efficiency, and ability to deliver value to investors. The focus on established defense companies with a proven track record ensures a degree of stability and reliability, while acknowledging that a backward-looking approach may not fully capture emerging opportunities. Innovative companies developing cutting-edge technologies, particularly in areas such as artificial intelligence, cyber warfare, and space-based systems, are also worth considering for investors seeking higher growth potential.

Six Defense Stocks Poised for Growth

Based on the aforementioned criteria, six defense stocks emerge as potential investment candidates: Transdigm Group (TDG), HEICO Corporation (HEI), Curtiss-Wright Corporation (CW), Woodward (WWD), BWX Technology (BWXT), and Cadre Holdings (CDRE). These companies demonstrate strong financial performance, promising growth prospects, and diverse product portfolios within the defense and aerospace sectors.

Transdigm Group (TDG) and HEICO Corporation (HEI): Leaders in Aftermarket Parts

Transdigm Group and HEICO Corporation are both prominent players in the aftermarket parts segment of the aerospace and defense industry. TDG boasts an impressive operating margin exceeding 45%, reflecting its efficient operations and high-value product offerings. The company’s decentralized structure, comprising 50 independently operating units, allows for specialized expertise and agility in addressing market demands. HEICO, on the other hand, shines with its exceptional revenue growth, averaging nearly 28% over the past three years. Both companies have a proven track record of successful acquisitions, further enhancing their growth potential.

Curtiss-Wright Corporation (CW) and Woodward (WWD): Diversified Product Portfolios

Curtiss-Wright and Woodward offer diversified product portfolios spanning both aerospace and defense, as well as other industrial sectors. CW consistently surpasses analyst expectations for revenue and earnings, demonstrating its robust financial performance. The company’s strength in defense electronics and naval systems positions it well for continued growth. Woodward’s dual focus on aerospace and industrial equipment provides revenue diversification, mitigating potential risks associated with fluctuating defense budgets. Despite anticipated slower growth in the near term, WWD remains a compelling investment opportunity due to its strong track record and diversified business model.

BWX Technology (BWXT) and Cadre Holdings (CDRE): Niche Players with Growth Potential

BWX Technology and Cadre Holdings cater to specific niche markets within the defense sector. BWX specializes in nuclear components for both government and commercial applications, benefiting from the growing global interest in nuclear energy as a low-carbon power source. The company’s unique licensing for handling special nuclear materials provides it with a competitive advantage in securing high-value contracts. Cadre Holdings focuses on safety and security equipment, including body armor, bomb suits, and forensic products. The company’s recent acquisition of Carr’s Engineering division further expands its market reach and strengthens its position in the nuclear safety and protection sector.

Investment Considerations and Outlook

Investing in the defense sector requires careful consideration of various factors, including geopolitical risks, budgetary constraints, and technological advancements. While the current outlook is positive, investors should conduct thorough due diligence and assess the specific risks and opportunities associated with each company. The six stocks highlighted in this analysis represent a diverse range of investment options within the defense sector, offering varying levels of risk and potential returns. By carefully evaluating these factors, investors can make informed decisions and position their portfolios to benefit from the anticipated growth in defense spending.

Beyond the Established Players: Exploring Emerging Technologies

While established defense companies provide a solid foundation for investment, it is crucial to recognize the transformative potential of emerging technologies. Innovations in areas such as artificial intelligence, autonomous systems, cyber security, and space-based technologies are reshaping the defense landscape. Investors seeking higher growth potential should consider researching and identifying companies at the forefront of these technological advancements. Early adoption of disruptive technologies can lead to significant returns as these innovations become increasingly integrated into defense systems and strategies.

Conclusion: A Strategic Approach to Defense Investing

The defense sector presents a dynamic investment landscape with both established players and emerging opportunities. By focusing on companies with consistent financial performance, innovative product offerings, and a strong growth outlook, investors can position themselves to capitalize on the increasing demand for defense capabilities. A diversified approach, combining established companies with exposure to disruptive technologies, can further enhance portfolio returns and mitigate risks associated with geopolitical uncertainty. Continuous monitoring of market trends, technological advancements, and budgetary developments is essential for successful long-term investment in the defense sector.