Bargain Hunting Amongst the Fallen Giants: An Investment Strategy for 2025

As the year 2024 concludes, it’s an opportune time to sift through the debris of the stock market, searching for hidden gems among the year’s worst performers. This contrarian approach focuses on identifying companies with depressed valuations that possess the potential for a resurgence. The goal is to capitalize on market overreactions and scoop up undervalued stocks before they rebound. This year, three companies stand out among the wreckage: Intel, Moderna, and Walgreens.

Intel: A Chip Off the Old Block with Renewed Potential

Intel, once the undisputed king of the semiconductor industry, has experienced a dramatic fall from grace, trading 73% below its all-time high. The company stumbled in the transitions to mobile devices and artificial intelligence, leading to a significant decline in earnings since 2021. The recent ousting of CEO Pat Gelsinger underscores the challenges Intel faces. However, amidst the gloom, there are glimmers of hope. Intel’s significant domestic manufacturing presence positions it to benefit from the Chips and Science Act of 2022, a government initiative aimed at bolstering domestic chip production. This financial support, coupled with the company’s low valuation near book value, presents a compelling investment opportunity. While challenges remain, the current price reflects the inherent risks, creating a potentially favorable risk-reward scenario for long-term investors.

Moderna: Beyond the Pandemic, a Future of Innovation

Moderna, a key player in the fight against the Covid-19 pandemic, has seen its stock plummet 91% from its pandemic peak. While the company currently faces losses, its strong balance sheet, with substantial cash reserves and low debt, provides a crucial runway for future development. Moderna’s messenger RNA (mRNA) technology platform holds immense promise beyond its initial application in COVID-19 vaccines. This innovative approach has the potential to revolutionize the development of new drugs and therapies for a wide range of diseases. The current depressed stock price provides an attractive entry point for investors willing to bet on the long-term potential of mRNA technology.

Walgreens: Navigating a Rough Patch Towards Recovery

Walgreens, a well-established pharmacy chain, has faced recent struggles, leading to losses in the past two fiscal years. However, the narrative of imminent bankruptcy is overly pessimistic. The company has a long history of profitability and a significant portion of its stores remain profitable. The CEO’s announcement of planned store closures reflects a proactive approach to streamlining operations and improving profitability. Furthermore, rumors of a potential acquisition by a private equity firm add another layer of intrigue to the Walgreens story. These factors suggest that Walgreens has the potential to navigate its current challenges and regain its footing in the market.

Celanese and Five Below: Less Promising Prospects

Celanese, a chemical company, has experienced a significant earnings decline this year, primarily due to increased competition and weakness in the automotive industry. While a recovery is possible, the company’s high debt levels present a substantial hurdle. Five Below, a retailer targeting teens and tweens, faces potential headwinds from proposed tariffs on imported goods. The company’s reliance on low-priced merchandise, often sourced from overseas, makes it vulnerable to trade policy changes.

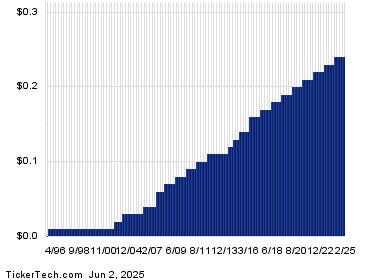

A Track Record of Contrarian Success

The strategy of investing in the year’s biggest losers has historically yielded positive results, outperforming the market over the long term. While not every pick has been a winner, the large gains from successful selections have more than offset the losses. It’s important to note that past performance is not indicative of future results, and investment decisions should be made after careful consideration of individual circumstances and risk tolerance.

Disclosure and Disclaimer

Transparency is paramount in investment advice. It is essential to disclose any potential conflicts of interest, such as personal holdings in the recommended stocks. Furthermore, it is crucial to emphasize that hypothetical results and past