CVS Health has earned a distinguished position among the top 25 dividend stocks, as recognized by Dividend Channel’s “DividendRank” report. This accolade stems from a comprehensive evaluation of CVS Health’s financial performance, showcasing a compelling combination of attractive valuation metrics and robust profitability. The report highlights the company’s current share price, which, when juxtaposed with its book value and dividend yield, presents a compelling investment opportunity. Trading at a price-to-book ratio of 0.8, significantly lower than the average of 2.6 for comparable companies, CVS Health demonstrates undervaluation, suggesting the market may be underestimating its true worth. Furthermore, its impressive annual dividend yield of 5.81% surpasses the average yield of 4.4% offered by its peers, further solidifying its appeal to income-seeking investors.

The DividendRank report emphasizes the significance of CVS Health’s consistent dividend payments, particularly its strong quarterly dividend history, as a key indicator of financial stability and commitment to shareholder returns. This consistent track record, supported by favorable long-term growth trends in fundamental financial data points, reinforces the company’s position as a reliable dividend payer. The report underscores the value of analyzing a company’s dividend history as a crucial factor in assessing the likelihood of future dividend sustainability. By examining past performance, investors can gain valuable insights into a company’s financial health and its ability to maintain and potentially increase its dividend payouts over time.

Dividend Channel’s proprietary DividendRank formula constitutes the backbone of their analysis. This formula meticulously assesses both profitability and valuation metrics across a wide range of companies, identifying those that stand out as particularly “interesting” investment prospects. This approach prioritizes companies demonstrating both strong financial performance and attractive valuations, presenting a compelling combination for value-oriented dividend investors. The formula serves as a valuable tool for investors seeking to identify companies that merit further investigation, providing a curated list of potential candidates based on quantifiable financial criteria.

The core philosophy of the DividendRank approach revolves around identifying companies that are not only financially robust but also trading at valuations that represent a potential bargain. Value investors, who prioritize investments offering a margin of safety, are particularly drawn to such opportunities. The combination of strong profitability and attractive valuation suggests that the market may be underestimating the true intrinsic value of these companies, creating a potential for future price appreciation in addition to the income generated by dividends. This dual benefit of potential capital gains and consistent income streams makes these stocks particularly appealing to long-term investors seeking a balanced portfolio.

CVS Health’s annualized dividend of $2.66 per share, distributed in quarterly installments, provides a steady income stream for investors. The most recent dividend ex-date, a crucial date for investors seeking to receive the upcoming dividend payment, was January 23, 2025. This reinforces the company’s commitment to returning value to shareholders and highlights the importance of monitoring these key dates to ensure timely participation in dividend distributions. The regular distribution of dividends provides investors with a tangible return on their investment, further enhancing the appeal of CVS Health as a dividend stock.

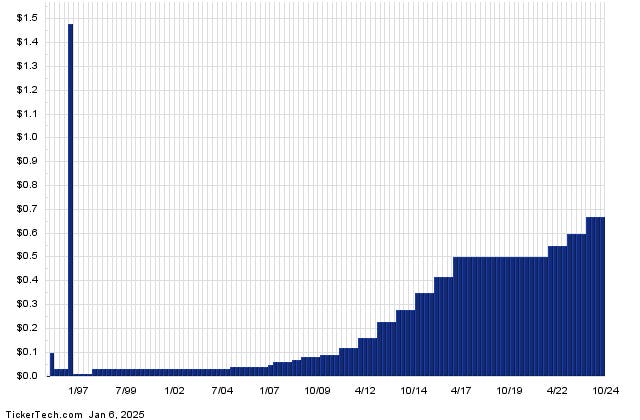

The report places strong emphasis on the examination of a company’s long-term dividend history, providing a visual representation of CVS Health’s dividend payments over time. This historical data allows investors to assess the consistency and growth of the company’s dividend payments, providing valuable context for evaluating the sustainability of future distributions. By analyzing past dividend trends, investors can gain insights into the company’s financial policies and its commitment to rewarding shareholders through consistent and potentially increasing dividend payouts. This long-term perspective is crucial for making informed investment decisions based on a company’s track record and financial stability.

The combination of strong financial performance, attractive valuation, and a consistent dividend history positions CVS Health as a compelling investment opportunity for dividend-focused investors. The DividendRank report highlights the company’s strengths, offering a valuable perspective for investors seeking stable income and potential capital appreciation. By emphasizing the importance of both profitability and valuation, the report underscores the value of a comprehensive approach to investment analysis, considering both current performance and future potential. This holistic approach allows investors to identify companies that offer a compelling combination of financial strength and market opportunity.