Rithm Capital (RITM) has secured a coveted spot among the top 10 Real Estate Investment Trusts (REITs), as recognized by Dividend Channel’s latest “DividendRank” report. This prestigious ranking underscores RITM’s compelling combination of attractive valuation metrics and robust profitability, making it a particularly appealing prospect for dividend-focused investors. The report highlights RITM’s recent share price of $10.86, which translates to a price-to-book ratio of 0.9, significantly lower than the average of 2.6 for comparable stocks. Furthermore, RITM boasts an impressive annual dividend yield of 9.21%, dwarfing the 4.4% average yield observed within Dividend Channel’s coverage universe. This combination of a low price-to-book ratio and a high dividend yield positions RITM as a potentially undervalued and high-yielding investment opportunity. The report further emphasizes RITM’s consistent quarterly dividend history and positive long-term growth trends in key fundamental data points, further solidifying its appeal.

Dividend Channel’s proprietary DividendRank formula serves as the backbone of this ranking. This formula prioritizes both profitability and valuation metrics to identify the most compelling investment opportunities within the coverage universe. By focusing on companies exhibiting strong financial performance coupled with attractive valuations, the DividendRank formula aims to pinpoint stocks that warrant further investigation by value-conscious dividend investors. This approach aligns with the core investment philosophy of seeking out fundamentally sound companies trading at prices below their intrinsic value. RITM’s inclusion in the top 10 underscores its alignment with these criteria, suggesting a potentially lucrative investment opportunity for those prioritizing dividend income and long-term value appreciation.

REITs, by their very structure, occupy a unique position in the investment landscape, particularly for income-seeking investors. Their legal obligation to distribute at least 90% of taxable income as dividends annually results in generally higher yields compared to other asset classes. This mandatory distribution policy makes REITs a natural fit for investors seeking consistent income streams. However, this requirement also introduces an element of volatility in dividend payments. While periods of strong profits can lead to substantial dividend payouts, periods of losses can result in reduced dividends or even their complete suspension. This inherent variability in dividend distributions necessitates a thorough understanding of the REIT’s underlying business and financial performance.

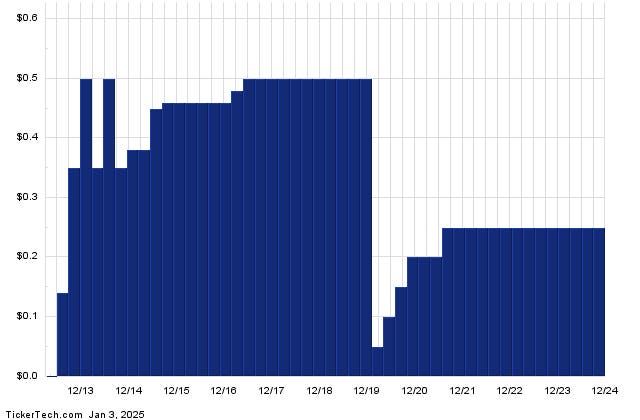

RITM’s current annualized dividend stands at $1 per share, paid in quarterly installments. The most recent dividend ex-date was December 31, 2024. The Dividend Channel report emphasizes the importance of analyzing a company’s long-term dividend history to assess the sustainability of current dividend payments. A consistent and growing dividend history can serve as a positive indicator of a company’s financial health and its commitment to returning value to shareholders. Conversely, a history of erratic or declining dividends may signal underlying financial challenges and raise concerns about the future trajectory of dividend payments.

In conclusion, RITM’s inclusion in Dividend Channel’s top 10 REITs list highlights its attractive combination of strong profitability, compelling valuation, and a solid dividend history. Its low price-to-book ratio relative to its peers and its high dividend yield suggest it might be undervalued. However, the inherent volatility in REIT dividend payouts, tied to their mandated distribution policy, necessitates a careful evaluation of RITM’s underlying business and financial performance. Investors should consider RITM’s long-term dividend history and future growth prospects alongside its current valuation metrics to make a well-informed investment decision. While the DividendRank report serves as a valuable starting point, further due diligence is crucial to assess the long-term viability and suitability of RITM as an investment.

Furthermore, investors must consider the broader macroeconomic environment and its potential impact on the real estate sector when evaluating REITs like RITM. Factors such as interest rates, inflation, and economic growth can significantly influence the performance of REITs. Rising interest rates, for instance, can increase borrowing costs for REITs and potentially dampen their profitability. Similarly, economic downturns can negatively impact real estate demand and rental income, affecting REITs’ financial performance and dividend payouts. Therefore, a comprehensive analysis of RITM requires considering both company-specific factors and the broader economic context to assess the potential risks and rewards associated with the investment.