The Wisdom of Transparency: Embracing Open Communication in Estate Planning

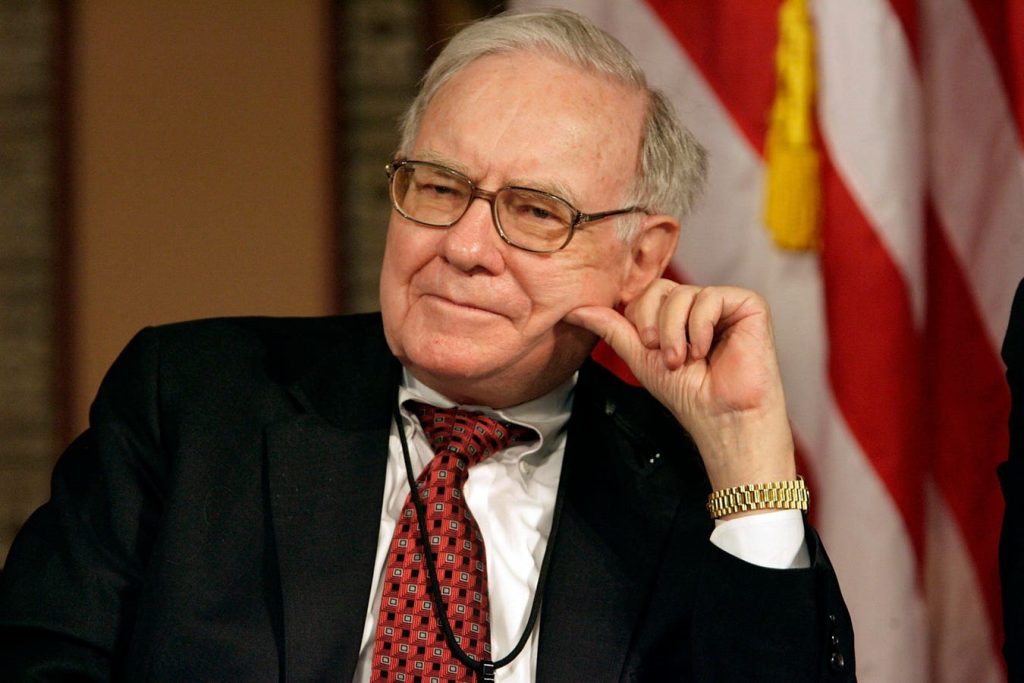

Warren Buffett, a name synonymous with financial acumen, recently offered advice that transcends the realm of investment strategies and delves into the often-overlooked territory of estate planning. His simple yet profound recommendation is to review your will and openly discuss it with your family and beneficiaries. While Buffett’s vast fortune may dwarf the holdings of most individuals, his wisdom holds universal relevance. Open communication about estate plans can transform a potentially stressful and contentious process into a constructive dialogue, fostering understanding, clarity, and ultimately, a smoother transition of assets. This approach mitigates the potential for confusion, conflict, and heartache, allowing families to navigate the complexities of inheritance with greater ease and harmony.

Illuminating Intentions and Empowering Beneficiaries

The cornerstone of effective estate planning lies in transparency. Openly discussing your will allows beneficiaries to grasp not just the distribution of assets, but also the rationale behind your decisions. This understanding fosters acceptance and reduces the likelihood of disputes arising from perceived inequities or misunderstandings. For those appointed as executors, trustees, or holders of powers of attorney, these conversations serve as crucial preparation. They provide an opportunity to familiarize themselves with their responsibilities, ask clarifying questions, and address any concerns before they assume these critical roles. This proactive approach can prevent surprises, minimize the potential for errors, and ensure a more efficient execution of your wishes.

Facilitating Financial Preparedness and Avoiding Future Conflicts

Beyond clarifying intentions, open communication about estate matters facilitates better financial planning for loved ones. While financial matters are often shrouded in secrecy, transparency can spark meaningful conversations about financial well-being. It can create an environment where family members feel comfortable discussing their financial situations, potentially revealing unforeseen needs or challenges. This open dialogue can prompt early assistance for those struggling financially and allow others to adjust their own financial plans in anticipation of an inheritance. Such proactive discussions can mitigate potential future conflicts and ensure that resources are allocated in a way that truly benefits the family.

Preventing Disputes and Expediting the Estate Settlement Process

Estate disputes, often fueled by ambiguity and miscommunication, can be emotionally and financially draining. When heirs are unclear about their inheritance or the reasoning behind specific allocations, the likelihood of contested wills and protracted legal battles increases significantly. By fostering open communication about your estate plan, you proactively address potential points of contention, minimizing the risk of future disputes. This clarity also streamlines the estate settlement process, reducing delays and allowing beneficiaries to access their inheritance more efficiently. A well-communicated estate plan minimizes the potential for conflict and facilitates a smoother transition.

Honoring Individual Preferences and Building a Legacy of Financial Literacy

Reviewing your will with family provides invaluable insights into their individual preferences and desires. Understanding which heir cherishes a particular heirloom, prefers a family home over other assets, or has specific financial needs allows you to tailor your estate plan to better reflect their values and priorities. This personalized approach can significantly reduce conflicts over sentimental or high-value items, ensuring a more equitable and harmonious distribution of assets. Moreover, these conversations can serve as valuable educational opportunities, allowing you to impart financial wisdom and insights gained throughout your life. Sharing your financial journey, investment strategies, and estate planning considerations can empower the next generation to make informed financial decisions and build their own legacies of financial security.

Transforming Anxiety into a Celebration of Life and Legacy

Estate planning, often perceived as a morbid or uncomfortable topic, can be transformed into a celebration of life and legacy through open and honest communication. By initiating these conversations, you foster an environment of trust, understanding, and shared responsibility. This approach allows your family to engage in a constructive dialogue about your wishes, ensuring that your final intentions are honored and your legacy endures. By embracing transparency and proactive communication, you can navigate the complexities of estate planning with grace and ensure a smoother transition for your loved ones, ultimately transforming a potentially stressful process into a meaningful affirmation of your values and the bonds that unite your family.