2025 Investment Themes: Riding the Waves of Innovation and Change

The year 2024 witnessed remarkable growth in the U.S. stock market, fueled by powerful investment themes such as Artificial Intelligence (AI), surging energy demands, the resurgence of cryptocurrencies, advancements in GLP-1 drugs, and infrastructure development. As we look ahead to 2025, several of these trends are poised for continued expansion, while new opportunities are emerging on the horizon. William O’Neil + Co.’s equity analysts have identified key investment themes that could shape market performance in the coming year.

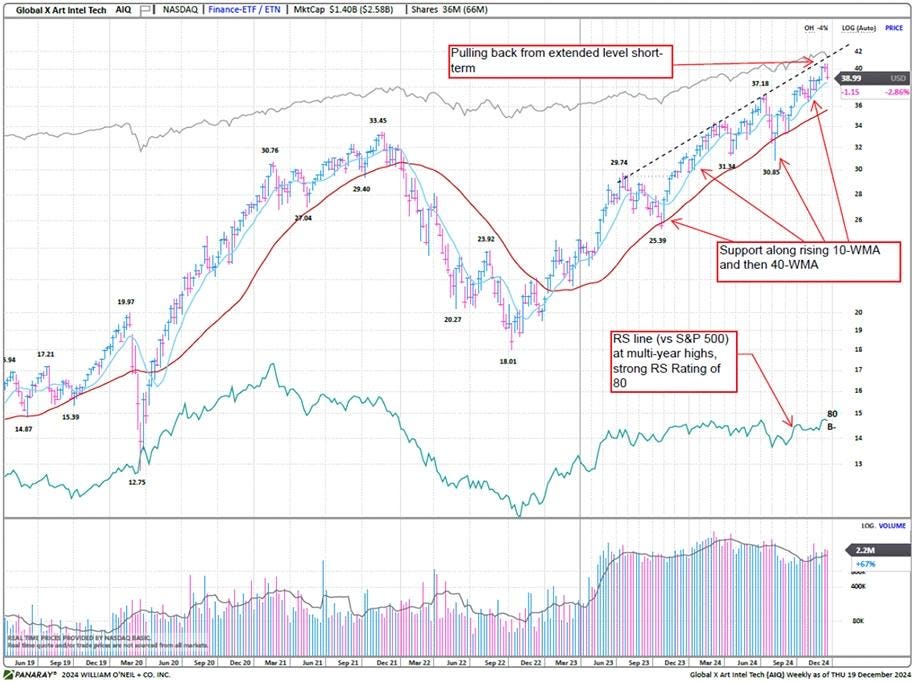

Artificial Intelligence: Pervasive Impact Across Sectors

AI remains a dominant force, with generative AI projected to achieve a staggering 10-year Compound Annual Growth Rate (CAGR) of 46%, reaching a market value of $1.6 trillion by 2032. Within this, software generative AI is expected to grow even faster, at an 84% CAGR, accounting for nearly half of the total generative AI market. This transformative technology will revolutionize diverse software sub-segments, including enterprise productivity tools, cybersecurity, data analytics, software infrastructure monitoring, advertising and search, and IT services. The AI arms race among hyperscalers like Alphabet, Amazon, Microsoft, and Meta is driving massive investments in data center infrastructure, creating substantial growth opportunities for chip and networking providers like Nvidia, Broadcom, and Arista Networks.

Industrials: Building the Foundation for the AI Revolution

The escalating demand for data centers, fueled by AI and other data-intensive applications, is projected to drive the data center physical infrastructure market at an 11.5% CAGR through 2029. AI data centers, with their significantly higher power requirements, are pushing the demand for power management solutions like switchgear and transformers. Furthermore, the immense computing power of AI data centers is driving the adoption of liquid cooling technologies, which offer vastly improved efficiency compared to traditional air cooling. This emerging technology is expected to experience rapid growth, with the global liquid cooling market projected to reach $12.8 billion by 2029. Companies specializing in cooling systems and power management products are well-positioned to benefit from this trend.

Energy: Powering the Digital Age

The projected growth of electricity demand in the U.S. has surged dramatically, driven largely by the growing power needs of data centers. With data centers expected to consume over 9% of U.S. electricity by 2030, the need for new generation and transmission capacity is paramount. This surge in demand presents significant opportunities for engineering, procurement, and construction companies, as well as providers of transformers and other grid infrastructure products. Natural gas and nuclear power are anticipated to play crucial roles in meeting this increased electricity demand. The rise of AI and data centers, along with the ongoing transition away from coal, is driving increased demand for natural gas-fired power plants. Concurrently, there is renewed interest in nuclear power, with both existing plants and new advanced reactor designs contributing to increased capacity.

Consumer Spending: Navigating a Shifting Landscape

While inflation is easing, persistent price increases continue to influence consumer behavior. A selective spending approach is expected to prevail, with consumers prioritizing value and seeking out products that meet their needs at reasonable prices. This trend favors brands that resonate with higher-income households, while those targeting lower-income demographics face challenges. Key themes shaping consumer spending in 2025 include a focus on health and wellness, driving demand for functional beverages, high-protein foods, and other products that support well-being. Innovation and technology integration are also crucial, with consumers seeking personalized experiences and brands that can adapt to rapidly evolving trends. Finally, experience-driven consumption is gaining momentum, as consumers increasingly prioritize travel, live events, and other meaningful experiences over material possessions.

Internet: The Rise of Video Ad Monetization

The shift in viewership towards streaming platforms and the corresponding migration of advertising dollars is creating significant opportunities for video ad monetization. Streaming services are introducing ad-supported tiers to capitalize on this trend, positioning themselves to capture a larger share of ad spending. Digital video ad spending is projected to surpass linear TV by 2027, presenting a substantial growth opportunity for Connected TV (CTV) streaming. The increasing availability of live sports on streaming platforms will further accelerate this shift. Established streaming giants like Netflix, Disney, and Warner Bros. Discovery are prioritizing profitability in their streaming businesses. The growth of short-form video platforms like Meta’s Reels and Alphabet’s YouTube Shorts is also contributing to the expansion of the digital video ad market. Programmatic ad players like The Trade Desk and Magnite are poised to benefit from the increased video ad inventory across both digital and CTV platforms.

Looking Ahead: A Year of Opportunity

2025 promises to be another dynamic year for investors, with both established and emerging themes shaping market performance. The themes outlined by William O’Neil + Co. provide valuable insights for investors seeking to navigate the evolving investment landscape and identify potential opportunities for growth. The convergence of transformative technologies, evolving consumer preferences, and shifting energy dynamics creates a fertile ground for innovation and investment. By staying informed about these trends and conducting thorough research, investors can position themselves to capitalize on the opportunities that lie ahead.