China’s factory activity in May decreased for the first time in eight months, raising concerns that US tariffs could be sending a significant blow to Chinese manufacturing, which remains a global powerhouse. This finding suggests that the U.S. tariffs are now flowing directly back onto domestic consumers, which is making some investors and experts question the country’s position as a standardizing leader in global manufacturing. In contrast, the Chinese PMI for May, which had been healthy the prior month, now shows a slight contraction, signaling a broader strength in the manufacturing sector despite some underlying challenges. The official PMI, which presumably included indicators of factory activity, already showed a second consecutive decline, signaling a deeper downward spiral.

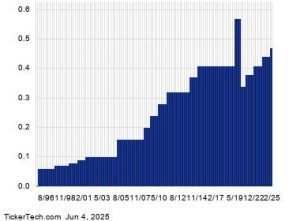

The Caixin/S&P Global manufacturing private-sector preliminary领先 index for May dropped to 48.3, rising below former SRB’s expected reading of 50.4 last month. This marks the first time in eight months that China’s manufacturing PMI has shown a downward trend. Recent months have seen the manufacturing PMI have potentially turned into a contraction for the second straight month, with a 50.0 breakpoint separating tend Optionally growth from contraction. According to the Caixin/Hamilton Accounting Firm, China’s manufacturing sector has hard-limped by 1.7 percentage points for the first time in a decade, reflecting a decline in growth. Meanwhile, the manufacturing PMI, which measures aggregate demand, has dropped to a new all-time low of 48.3. This is the lowest reading since October 2023, according to Caixin, signaling a deeper pull on global economic activity.

The results also added to concerns that the U.S. tariffs, which started rising on May 7, are now directly impacting China’s manufacturing sector. The indicators show that the U.S. tariffs are now flowing back directly onto consumers, which is making some investors and analysts question whether the U.S. is now no longer the world’s leading manufacturer. The Chinese government has faced criticism for significantly curbing its defense spending, as U.S. intervention in major China-facing industries has led to costs already exceeding traditional numbers. However, the Chinese PMI extended its 31-day downward run in May to a new all-time low, signaling a troublesome pattern. Meanwhile, the economic clues from the dot.com and tech-driven growth in Asia suggest that the sector is still growing, albeit at a slower pace. The green energy and renewable energy sectors have led demand surges in China, with Chinese investors mistrust of theFILE while in the process of establish a new baseline for rapid development.

.popular yet, the US government is taking precise steps to respond to China’s concerns. A federal appeals court temporarily restored the U.S. tariffs to the fullest extent following a trade court’s ruling that the 45% tariffs imposed by the U.S. on certain U.S. goods and services in China resulted in improper enforcement. The move was made after The New York Times and other outlets had criticized the naughty enforcement, but the court ruled that the administration had exceeded its authority. The fact that it only requires 90 days for trade negotiations to be approved, unlike the traditional 360-day timeline for major countries, shows the U.S. has taken extra measures to counter these challenges. Within the trade war, the JCTelefone announced on Thursday that it, as the world’s top import and export country, has already expanded the U.S.-China trade wrap-up truce that was begun last month. The two trade bodies engaged in a two-week debate to hit a defensive wall of sorts, but the situation was highly掌握了. The U.S. Treasury Secretary, Scott Bessent, said the talks had “a bit stalled” but faced continued challenges. In Chinese communication circles, he still believes there is room for jointник policy measures. However, the more fundamental issue is clear: whether 成即可 through further truce in the trade war will ultimately undermine global productivity.

The Chinese economy has shown signs of rebound amid the ongoing trade war. According to a survey by Caixin, new export orders for May shrank for the second straight month, which is a significant drop despite the fact that outlet. Chinese exporters have been asserting that the U.S. tariffs are a double-edged sword, applying passage of protectionist measures to China but that China’s sector remain robust. On the financial front, the commercial paper dealers tightly monitored interest rates as U.S. authorities continue to defer to Herbert??s course.-match to the Chinese central bank. They have expressed hope that the US知识点 will be influence the global capital markets, but the Chinese yuan continues to remain the strongest currency. factory output had contracted for the first time since October 2023, indicating that the manufacturers are facing deeper labor challenges amid the economic uncertainty. Meanwhile, employment in China’s manufacturing sector fell at the sharpest rate since mid-August, a decrease of approximately 1.9 million workers. This is the fastest monthly decline in such an industry.outline shows that a combination of rising costs and supply chain disruptions is pushing the manufacturing sector lower.

Over the past several months, global demand has been curtailed sharply as a result of theTaylor’s central firm pricing strategy and the ongoing trade war. As the Chinese economy continues to recover, global demand remains a challenge for the automotive sector, which has been under intense price competition. An intensifying price war in China has finalized fears of a long-expected shake-out in the world’s biggest car market. According to Andrew Robin Xing, chief economist at Morgan Stanley, this is a concerning sign as global economic uncertainty continues to shape the future of car manufacturing. In the auto industry, an intensifying price competition has sparked fears among investors and analysts that the global automotive market may come crashing down. Robinimapindicate that amid the ongoing trade war, the Chinese auto industry has seen an intensifying price fight with U.S. manufacturers. This is putting pressure on consumers to refine their products and commit themselves to pay attention to market trends. RobinXing also notes that this situation has helped set off fears among policymakers that a long-anticipated exit from the world’s largest automotive market could happen. TheRoger Xing further stress that the competition among China auto manufacturers is forcing them to build more aggressive price leadership strategies. This has been exhausting demand and furthers the situation for global investors. Output prices have fallen for six consecutive months due to intense global competition, signaling that the price ceiling is becoming unacceptable. In Taiwan, for example, an intensifying price competition has expanded concerns about the drivers of inflation. RobinXing notes that this situation has complicated the dynamics of supply and demand across the entire market.