Thailand’s cabinet, under the leadership of Prime Minister Paetongtarn Shinawatra, has unveiled a comprehensive debt relief package aimed at alleviating the burden on households and smaller businesses grappling with mounting debt. This initiative, announced on Wednesday, December 11th, encompasses a range of measures designed to provide immediate financial respite to struggling borrowers. Central to this strategy are interest suspensions and reductions in principal payments, offering a lifeline to those facing imminent loan defaults. The government recognizes the crippling impact of high household debt on consumer spending and overall economic growth, and these measures are a direct response to this pressing concern.

The debt relief program targets borrowers whose loans are up to one year overdue, encompassing a wide spectrum of debt instruments. Specifically, the program covers housing loans up to 5 million baht (approximately US$148,060), car loans not exceeding 800,000 baht, and loans to small and medium-sized enterprises (SMEs) of up to 5 million baht. This targeted approach aims to provide the most significant impact to those segments of the population most vulnerable to the effects of economic downturns and rising interest rates. By focusing on these specific loan categories, the government hopes to stimulate consumer confidence and encourage spending, thereby bolstering economic activity.

In a parallel move designed to bolster the financial institutions’ capacity to absorb the impact of the debt relief measures, the cabinet also approved a reduction in the annual contribution that banks make to the Financial Institutions Development Fund (FIDF). The FIDF, which serves as the central bank’s rescue arm, typically receives 0.46% of banks’ deposits annually. This contribution will be reduced to 0.23% for the next three years, freeing up substantial capital for banks to support their debtors. This reduction effectively provides banks with additional financial flexibility to implement the government’s debt relief program and absorb potential losses without jeopardizing their overall stability.

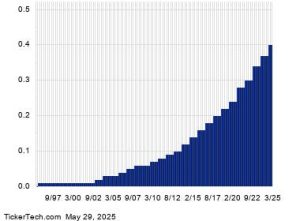

The government’s focus on household debt stems from the recognition that it represents a significant drag on the Thai economy. Thailand’s household debt-to-GDP ratio stood at a staggering 89.6% at the end of June, with total household debt reaching 16.3 trillion baht (US$482 billion). This figure places Thailand among the countries with the highest household debt levels in Asia, highlighting the urgency and importance of the government’s intervention. High household debt levels typically suppress consumer spending, as a significant portion of disposable income is allocated to debt servicing. This, in turn, hampers economic growth and can lead to a vicious cycle of debt accumulation and economic stagnation.

The Bank of Thailand, the nation’s central bank, subsequently provided further details on the debt restructuring program. The program’s framework emphasizes collaboration between financial institutions and their borrowers to develop customized repayment plans tailored to individual circumstances. This approach aims to create sustainable solutions that allow borrowers to manage their debt while minimizing the impact on their daily lives and overall financial well-being. The central bank highlighted the importance of open communication and transparency throughout the restructuring process, ensuring that borrowers fully understand the terms of their new agreements.

The government’s multi-pronged strategy, involving direct debt relief measures for borrowers and support for financial institutions through reduced FIDF contributions, underscores the seriousness with which the Thai government is addressing the issue of household debt. The success of this program will be crucial in mitigating the risks posed by high household debt levels and fostering a more sustainable and robust economic recovery. The government believes that by easing the debt burden on households and small businesses, it can unleash pent-up consumer demand and stimulate economic growth, paving the way for a more prosperous future. The Bank of Thailand and the government will continue to monitor the effectiveness of these measures and make adjustments as needed to ensure their optimal impact.