The Body Shop Canada Receives Court Approval for Sale to Serruya Private Equity

The Ontario Superior Court of Justice has granted The Body Shop Canada approval to sell a substantial portion of its business to Serruya Private Equity Inc., a Markham, Ontario-based firm. Justice Peter Osborne presided over the virtual hearing and expressed his well wishes for the success of the venture. This acquisition marks a new direction for Serruya Private Equity, whose portfolio primarily consists of investments in the automotive, real estate, and food service sectors, including brands like St. Louis Bar and Grill, Second Cup, and Swensen’s. While Serruya Private Equity has not publicly commented on the acquisition, legal representatives portrayed the firm as possessing the necessary sophistication and resources to revitalize the struggling retailer.

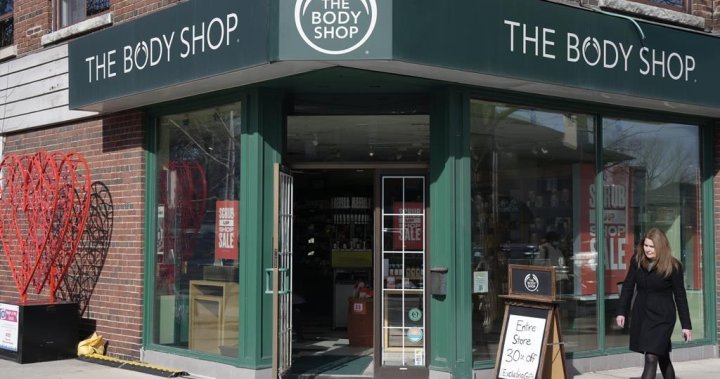

The Body Shop Canada initiated the search for a buyer in July, following its filing for creditor protection in March. The company attributed its financial difficulties to actions taken by its parent company, alleging that it was deprived of essential funds and burdened with excessive debt. The court-approved sale to Serruya Private Equity includes 59 properties currently owned by The Body Shop Canada, encompassing prominent locations such as the West Edmonton Mall, Toronto Eaton Centre, Pacific Centre in Vancouver, and Halifax Shopping Centre. However, the remaining stores, not included in the Serruya acquisition, are slated for liquidation.

The acquisition agreement entails the issuance of termination notices to approximately 600 employees, including 100 seasonal workers. However, around 500 employees are expected to be rehired under the new ownership. The court also granted a request to withhold the purchase price from public disclosure, citing commercial sensitivity. Legal representatives for The Body Shop Canada argued that revealing the price could jeopardize future sales attempts if the current deal with Serruya Private Equity were to fall through.

The Body Shop Canada’s financial struggles underscore the challenges faced by retailers in the current economic climate. The company’s decision to seek creditor protection and subsequently pursue a sale reflects the difficult decisions businesses must make to navigate economic downturns and ensure their survival. The acquisition by Serruya Private Equity offers a potential lifeline for the brand, leveraging the firm’s expertise and resources to restructure and revitalize The Body Shop Canada’s operations. The closure of underperforming stores and the retention of a significant portion of the workforce suggest a strategic approach to streamlining operations and maintaining a presence in key markets.

The court’s decision to approve the sale and withhold the purchase price acknowledges the complexities of the transaction and the potential impact on the company’s future prospects. By protecting commercially sensitive information, the court aims to facilitate a smooth transition and maximize the chances of a successful outcome for The Body Shop Canada. The future of the brand now rests on the ability of Serruya Private Equity to implement a viable turnaround strategy, capitalizing on The Body Shop’s established brand recognition and loyal customer base. The transition period will undoubtedly present challenges, but the court’s approval and the new owner’s experience provide a foundation for potential recovery and growth.

The acquisition of The Body Shop Canada by Serruya Private Equity signifies a new chapter for the embattled retailer. While the immediate future involves store closures and workforce adjustments, the long-term goal is to revitalize the brand and restore its financial stability. The success of this venture will depend on a combination of factors, including strategic management, market conditions, and consumer response. The court’s approval and the involvement of a seasoned private equity firm offer a glimmer of hope for The Body Shop Canada, but the ultimate outcome remains to be seen. The retail landscape is constantly evolving, and The Body Shop Canada’s journey will be a test of its adaptability and resilience in a competitive marketplace.