The Final Chapter of the Madoff Victim Fund: A Saga of Deception and Restitution

The notorious Bernie Madoff Ponzi scheme, a dark chapter in financial history, has reached a significant milestone with the final distribution of funds to its victims. The Madoff Victim Fund, established by the Department of Justice over a decade ago, has disbursed its tenth and final payment, totaling $131.4 million, to more than 23,000 victims scattered across the globe. This final installment brings the total amount repaid to over $4.3 billion, a substantial sum that represents approximately 93.71% of the victims’ losses. This monumental effort, spanning over a decade, has provided a measure of justice and closure to nearly 41,000 individuals from 127 countries who fell prey to Madoff’s elaborate fraud. While the financial restitution cannot erase the emotional scars and devastating consequences of Madoff’s deceit, it marks a significant step towards rectifying the immense harm inflicted upon innocent investors.

Bernie Madoff, the architect of this colossal fraud, orchestrated what is widely considered the largest stock fraud in history. His scheme, which began to unravel during the financial crisis of the late 2000s, involved soliciting funds from investors under the guise of legitimate investments. However, instead of investing the money as promised, Madoff perpetuated a classic Ponzi scheme, using new investments to pay returns to earlier investors, creating an illusion of profitability. This elaborate charade continued for decades, ensnaring thousands of individuals, including retirees, charities, and prominent figures in sports and entertainment. Madoff’s web of deceit extended far and wide, impacting countless lives and leaving a trail of financial ruin in its wake.

The scale of Madoff’s fraud was staggering, involving billions of dollars and impacting a diverse range of victims. Among those defrauded were charities who had entrusted their funds to Madoff, believing they were supporting worthy causes, and retirees who had invested their life savings, hoping for a secure future. The list of victims also included high-profile individuals such as former Disney studio chief Jeffrey Katzenberg, baseball legend Sandy Koufax, and actors Kevin Bacon and Kyra Sedgwick. The breadth and depth of Madoff’s deception underscore the devastating impact of his crimes, leaving a legacy of financial hardship and emotional distress for thousands of families and organizations.

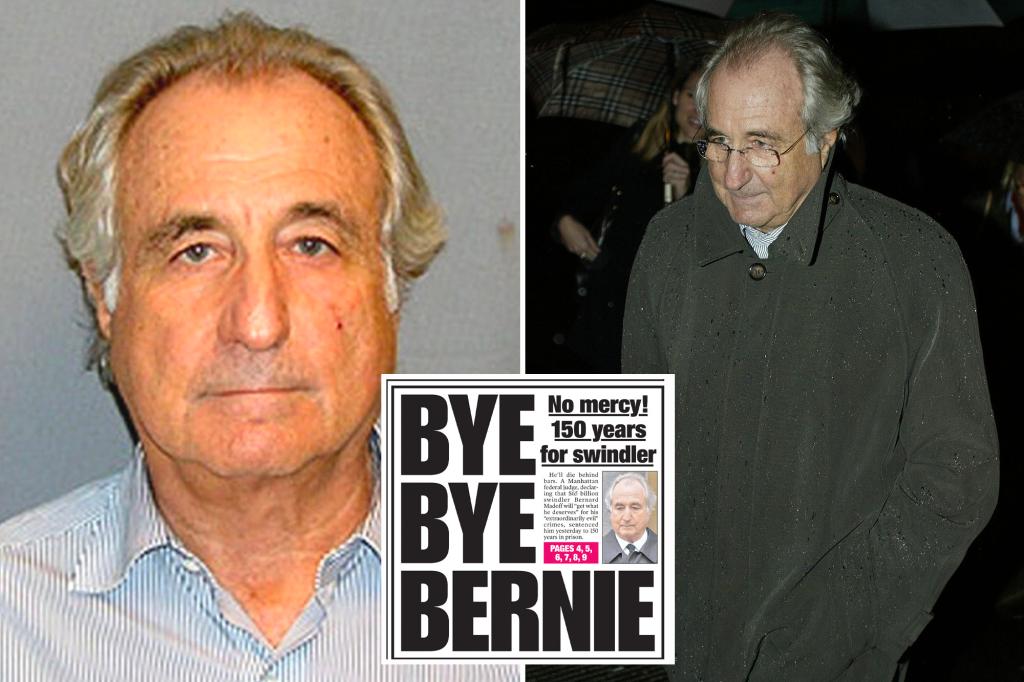

The unraveling of Madoff’s scheme and the subsequent legal proceedings brought the full extent of his crimes to light. In 2009, Madoff pleaded guilty to 11 financial crimes, including fraud, money laundering, and perjury. He admitted to operating his fraudulent investment firm, Bernie L. Madoff Investment Securities, since the 1990s, deceiving investors for decades. The court proceedings revealed the intricate workings of his Ponzi scheme, exposing the systematic manipulation and deception that allowed him to amass vast sums of money while leaving his victims financially devastated. The sheer magnitude of the fraud shocked the world and exposed the vulnerabilities of the financial system.

The human cost of Madoff’s crimes extended beyond financial ruin. The emotional toll on his victims was immense, leading to profound despair and, in some cases, tragic consequences. Madoff’s fraud has been linked to at least four suicides, including the suicide of his elder son, Mark, who hanged himself on the two-year anniversary of his father’s arrest. His younger son, Andrew, also attributed the recurrence of his rare cancer, mantle-cell lymphoma, to the stress and trauma caused by his father’s actions. These tragic events highlight the devastating ripple effect of Madoff’s crimes, leaving a trail of broken lives and shattered families.

The pursuit of justice for Madoff’s victims has been a relentless effort by the Department of Justice. Madoff himself was sentenced to 150 years in prison, a symbolic gesture reflecting the gravity of his crimes. He and his co-conspirators, including his brother Peter Madoff, were compelled to forfeit their ill-gotten gains, which contributed to the Madoff Victim Fund. Significant contributions also came from the estate of deceased Madoff investor Jeffry Picower and a settlement with JPMorgan Chase Bank. These efforts, spearheaded by the Manhattan US Attorney’s office, have been instrumental in recovering billions of dollars for the victims, demonstrating a commitment to holding perpetrators accountable and providing a measure of redress to those who suffered at their hands. Even in death, Madoff’s legacy continues to be one of infamy, a cautionary tale of greed, deception, and the devastating consequences of financial fraud.