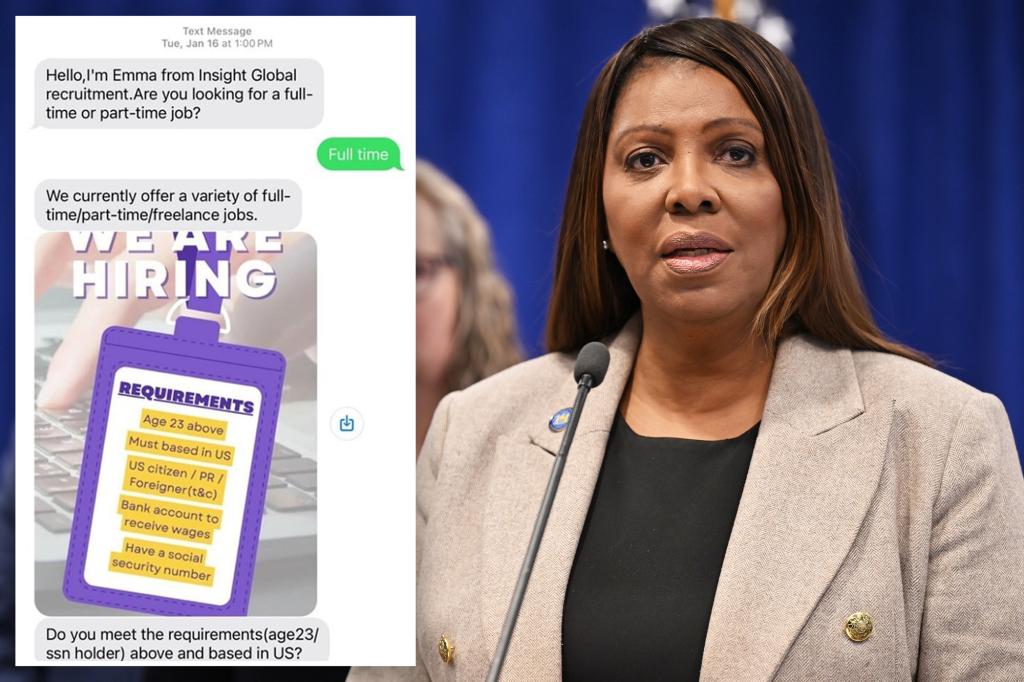

This case revolves around a sophisticated cryptocurrency scam orchestrated through unsolicited text messages, targeting individuals seeking remote work opportunities. The perpetrators, operating between January and June 2023, employed a consistent playbook to defraud victims across multiple states, including New York, Virginia, and Florida. The scheme involved luring victims with promises of high-paying, flexible remote jobs, often involving online product reviews. However, the true intention was to manipulate victims into opening cryptocurrency accounts and maintaining specific balances, ostensibly to legitimize their review activities. Once victims were financially invested, the scammers fabricated reasons for them to increase their cryptocurrency holdings, often under the guise of higher commission opportunities or fabricated withdrawal requirements. This ultimately led victims to deplete their savings, max out credit cards, and even borrow money from friends and family, all under the false pretense of legitimate employment.

The scammers constructed a web of fictitious companies with seemingly legitimate names, such as Digistore24 and CultureFit Technology, to mask their fraudulent operations and create an illusion of credibility. They further enhanced this deception by setting up fake websites with fabricated user accounts displaying fictitious earnings, reinforcing the illusion of a genuine work opportunity. This carefully crafted network of fake companies and websites served to build trust and encourage victims to invest more heavily in the scheme. As victims became increasingly entangled, the scammers applied relentless pressure, pushing them to review higher-value products and meet increasingly inflated “withdrawal points.” This tactic effectively trapped victims in a cycle of escalating financial commitment, driving them to desperate measures to maintain their supposed earnings and eventually leading to substantial financial losses.

The lawsuit filed by New York Attorney General Letitia James details the devastating impact of this scam on the lives of several victims. One Queens man, originally from India, lost over $58,000, resorting to both credit card debt and loans from friends and family. A Florida woman was tricked into depositing over $300,000 in just 20 days. The most poignant example is that of a Queens teacher, identified as “Mell,” who lost nearly $120,000. The scammers manipulated him with promises of significant returns while simultaneously fabricating obstacles to withdrawing his supposed earnings. Driven to desperation by the constant pressure and mounting financial strain, Mell reached a breaking point, expressing fears for his health and wellbeing.

Another victim, a 28-year-old woman from India identified as “June,” lost her entire life savings of $6,250 to the scam. After depleting her resources, including utilizing a credit card cash advance, she was pressured to invest even more. Upon realizing the futility of her situation, June expressed despair and hopelessness. These individual accounts underscore the devastating emotional and financial consequences of the scam, highlighting the manipulative tactics employed by the perpetrators to exploit vulnerable individuals seeking legitimate employment. The victims’ desperation to earn a living was cynically exploited, leaving them in dire financial straits and significant emotional distress.

The investigation, a collaborative effort involving the New York Attorney General’s office, the Queens District Attorney, and the U.S. Secret Service, has identified numerous cryptocurrency wallets controlled by the scammers, containing nearly $2.2 million in stolen funds. These accounts have been frozen, and the lawsuit aims to recover the stolen money and return it to the victims. Beyond financial restitution, the lawsuit seeks penalties against the perpetrators and a permanent injunction to prevent them from sending further unsolicited text messages within New York. This multifaceted approach aims not only to compensate victims but also to deter future instances of this type of fraudulent activity.

Given that the scammers remain anonymous, identified only by their cryptocurrency wallets, the Attorney General’s office is employing a novel method of service: depositing a non-fungible token (NFT) into each wallet, linking them to the legal proceedings. This innovative approach leverages blockchain technology to ensure the scammers are officially notified of the lawsuit, despite their attempts to remain anonymous. The Attorney General has also urged anyone who believes they may have been targeted by this or a similar text message scam to contact her office and file a complaint. This call to action emphasizes the importance of public vigilance and cooperation in combating online fraud and holding perpetrators accountable. The case serves as a stark reminder of the evolving nature of online scams and the need for individuals to exercise caution when engaging with unsolicited job offers, particularly those involving cryptocurrency transactions.