The Potential Impact of New Sanctions on Russian Energy

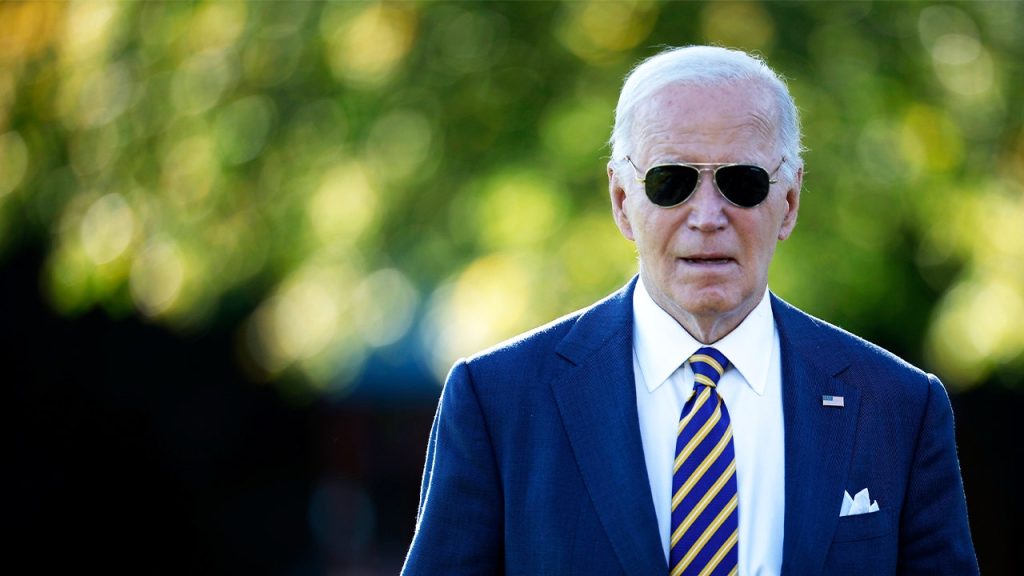

Reports suggest that President Biden is considering imposing new sanctions on Russia’s energy sector before leaving office. This move could have significant global implications, particularly in the energy market. Experts, analyzing previous sanctions imposed on Russia following its invasion of Ukraine, anticipate that new energy sanctions could lead to a temporary rise in global gas prices and a shift in oil export patterns. These potential consequences underscore the complex economic and political considerations surrounding sanctions against Russia.

Historical Context and Market Reactions

Sanctions targeting Russia’s energy sector have a precedent. The surge in natural gas prices in 2022, reaching record highs in the U.S. after Russia’s invasion of Ukraine, offers a glimpse into the potential market reactions. The Federal Reserve Bank of St. Louis highlighted the dual impact of these sanctions, reducing Russian revenues while simultaneously imposing costs on sanctioning nations. Furthermore, the global diesel market experienced significant disruption due to these sanctions. A lack of refining capacity combined with the halt in purchases of Russian energy exports led to a dramatic increase in diesel prices. The Producer Price Index for diesel in June 2022 saw a staggering 109% rise compared to June 2021, as reported by the Federal Reserve Economic Data (FRED). While prices have since decreased considerably, according to Bureau of Labor Statistics data, the initial impact underscores the market’s sensitivity to disruptions in Russian energy supply.

Geopolitical and Economic Implications

The American Enterprise Institute (AEI) emphasizes the potential for sanctions to reshape global oil trade. Imposing sanctions on Russian energy has the potential to cause substantial shifts in oil export patterns, creating inefficiencies and forcing sanctioned countries, including Russia, to sell crude oil at below-market prices. This dynamic creates opportunities for other oil-producing countries while potentially disrupting established trade relationships.

Political Considerations and Domestic Impact

The timing of these potential sanctions, after the U.S. presidential election, carries political significance. Edward Fishman, a senior research scholar at Columbia University’s Center on Global Energy Policy, suggested that the Biden administration’s previous caution regarding sanctions stemmed from concerns about rising gas prices and exacerbating inflation. With the election concluded and inflation seemingly under control, the perceived need for such caution has diminished, potentially paving the way for more aggressive action against Russia.

Recent Sanctions and the Nord Stream 2 Pipeline

The report of potential new sanctions follows shortly after the U.S. imposed fresh sanctions on several Russian-linked entities and individuals associated with the Nord Stream 2 pipeline project. This controversial undersea gas pipeline, connecting Russia to Germany, has been a focal point of geopolitical tension. The recently imposed sanctions underscore the Biden administration’s ongoing efforts to pressure Russia and signal its disapproval of the project.

Balancing Competing Interests

The potential decision to impose further sanctions on Russia’s energy sector represents a complex balancing act. The U.S. must weigh the desire to punish Russia for its actions in Ukraine against the potential economic consequences, both domestically and globally. Higher energy prices, disruptive shifts in trade patterns, and the potential for retaliatory actions by Russia all represent significant risks. However, the Biden administration may feel that the geopolitical benefits of further sanctions outweigh these economic concerns, particularly in light of the recent election and seemingly improving inflation situation. The ultimate impact of any new sanctions will depend on their scope, the reaction of the global energy market, and the response of Russia.