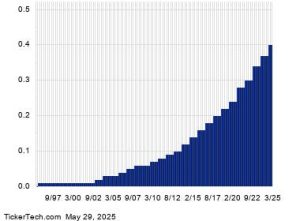

0% APR credit cards offer a powerful tool for managing debt and financing large purchases by providing an interest-free grace period, typically ranging from 9 to 21 months. This introductory period allows cardholders to carry a balance without accruing interest, providing significant savings compared to the average credit card interest rate exceeding 20%. However, it’s crucial to understand the terms and conditions, including the length of the introductory period, eligible transactions (purchases, balance transfers, or both), and any associated fees. Careful planning and timely repayment are essential to maximize the benefits and avoid accruing interest once the promotional period expires.

The 0% APR introductory period applies specifically to the designated transactions – either new purchases, balance transfers, or both. During this period, no interest accrues on these transactions, provided the cardholder makes the required minimum monthly payments. However, other fees, such as late payment fees, cash advance fees, and foreign transaction fees, may still apply even during the introductory period. Balance transfer cards often come with a balance transfer fee, usually 3% to 5% of the transferred amount, which should be factored into the overall cost analysis.

Balance transfer cards, a subset of 0% APR cards, facilitate debt consolidation by allowing cardholders to transfer existing high-interest credit card debt to a new card with a 0% introductory APR. This can significantly reduce interest payments and streamline debt management. However, the balance transfer fee must be considered. Calculating the potential interest savings against the balance transfer fee will determine the overall financial benefit.

The distinction between 0% APR and deferred interest is critical. Deferred interest offers, commonly found in retail promotions, postpone interest accrual until the end of the promotional period. However, if the full balance isn’t paid by the deadline, the deferred interest is added to the balance, potentially negating any savings. In contrast, 0% APR cards accrue interest only after the introductory period ends, even if the balance isn’t fully paid, as long as minimum payments are maintained.

Upon expiry of the 0% APR introductory period, the standard variable APR applies to the remaining balance. Several options exist for managing the remaining balance, including transferring the balance to another 0% APR card or securing a fixed-rate personal loan. Careful consideration of interest rates, fees, and repayment terms is essential when choosing a course of action. Closing the 0% APR card after the introductory period is generally not advisable, as this can negatively impact credit scores.

Maximizing the benefits of 0% APR credit cards requires a strategic approach. Understanding the terms and conditions, including the introductory period length, eligible transactions, and fees, is paramount. Planning for timely repayment before the promotional period expires is essential to avoid accruing interest at the standard variable rate. Comparing different 0% APR offers, considering balance transfer fees, and maintaining minimum monthly payments are crucial steps in leveraging these cards effectively.

Furthermore, it’s important to consider these key aspects of 0% APR credit cards:

-

Transaction Applicability: The 0% introductory period may apply to new purchases, balance transfers, or both. Carefully review the card terms to understand which transactions qualify for the promotional rate.

-

Introductory Period Length: The duration of the 0% APR period varies, typically ranging from 9 to 21 months. Opt for a card with the longest introductory period that aligns with your repayment plan.

-

Balance Transfer Benefits and Fees: Balance transfer cards can help consolidate high-interest debt, but be aware of balance transfer fees, typically 3% to 5% of the transferred amount.

-

Associated Fees: While interest is waived during the introductory period, other fees, such as late payment, cash advance, and foreign transaction fees, may still apply.

-

Minimum Payment Requirements: Making at least the minimum monthly payment is crucial to maintaining the 0% APR offer and avoiding penalties.

-

Credit Score Requirements: Most 0% APR cards require good to excellent credit scores. Building credit through responsible credit card usage can improve eligibility for these offers.

- Post-Introductory Period Strategy: Develop a plan for managing the remaining balance after the 0% APR period expires. Consider balance transfer options or personal loans to maintain favorable interest rates.

By carefully considering these factors and employing a strategic approach to repayment, 0% APR credit cards can provide a valuable financial tool for managing debt and making large purchases. However, responsible usage and adherence to the card terms are essential to avoid accruing unnecessary fees and interest charges.